Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday Discovery released a solid set of results for the full year ending June 30th. Starting off with the key figures, Normalised headline earnings are up 23%, new business is up 15% and embedded value is up 21%. The reason for using the new business number instead of revenue is because the revenue number is largely irrelevant to insurance based businesses.

Embedded value is the present value of all future profits with net asset value added on top. In layman's terms, insurance companies (based on historical averages) work out how much money they will be paying out every year in claims, which should be lower than the premiums that they receive. The difference between the pay outs and revenue is then the profit for the company. There are two problems with valuing a company by embedded value alone. The first is that embedded value assumes that your number of clients will not change going forward, which given Discovery's current growth rate means embedded value misses the mark. Another problem with embedded value is that the figure used to determine what is paid out in claims is based on actuarial calculations that uses historical averages, which change over time. In Discovery's case they paid out R1.4 billion less over the last financial year than the actuarial calculations said they should. This number shows the quality of Discovery's clients and that their incentive programs are working well!

The market cap of Discovery is at around R 60 billion rand which is 40% premium on the embedded value of R43 billion. Which as explained above there is a good reason for the premium.

The key for Discovery is the integration between their different products. An example is how tracking driving impacts on all their other products. If people drive better, there is a smaller chance of an accident so the odds are lower that their medical aid will have to pay out, lower odds that you will die in an accident and their life division will have to pay out and finally lower the odds that their insurance division will have to pay out. The result is dynamic pricing where you will pay less for insurance or get big rewards for being a lower risk. With dynamic pricing Discovery can be cheaper than competitors while at the same time making an increased profit because the quality of their clients is higher.

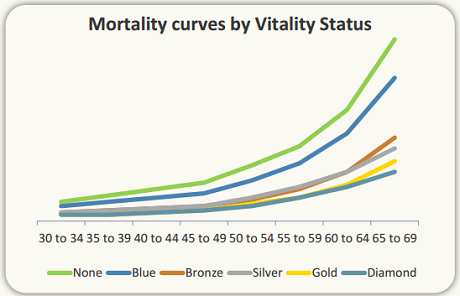

Their data also shows that with the incentives given, people change their habits for the positive. There is a strong correlation between people's status on their reward program and the number of claims. When people move over to Discovery insure only 27% of drivers are considered safe but after being at Discovery insure for a year that number almost doubles to 48%. Below is a graphic from Discovery showing mortality rates of their different clients. Clients being healthier and living longer means more premiums and lower pay outs.

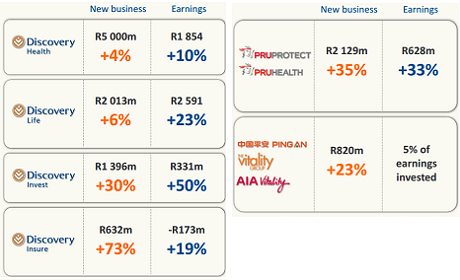

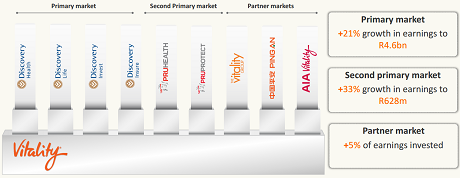

On to the breakdown of the figures of each of their divisions. The discovery images do a great job of giving a solid breakdown in a simple and clear manner.

As you can see the results are solid. The figure to point out is the loss on the Insure division, this is still a relatively new division which they figure will be in the black in around two years. As mentioned earlier there are synergies between the different divisions so even though this division is making a loss it is enhancing their other divisions. The next set of figures to point out is the size of the earnings numbers from all their divisions except the main two (Health and Life). There is significant space for them to continue to grow the earnings number, with them being new divisions you would expect the earnings number to be lower than the core part of the business.

The partner markets are in Asia, the USA and Australia. The basics of the model is that given Discovery's data sets and experience in dynamic pricing, they partner with existing insurers to help them start offering dynamic pricing. Discovery then gets a cut of the new profits from the new business. By partnering with existing insurers it means that they do not need to spend the capital to break into new markets and they also then get local knowledge form the partner. This is a good way to grow their business and time will tell how profitable it will be. With their Ping An partner in China, they are currently adding around 300 new clients a day!

The last number to mention is that they have increased their dividend to 151 cents for the year, an increase of 21.3%. Dividends are normally a side figure for people and the focus is all on capital growth. When a dividend is growing at 20% it doesn't take too long before the dividend paid is not too far off the original price that you paid for the stock! Another reason why the buy and hold strategy works well over the long run.

Discovery is still one of our favourite stocks! They are the disrupter in the insurance industry and are growing all over the world.