Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

There was something else that I wanted to add yesterday, about the character of Stephen Saad. We never quite know everything about the personal persona, to be honest that is too intrusive. I was amused at the headline yesterday, I didn't choose it, Byron did, well done champ. The truth is, even though Stephen Saad is wildly rich in his personal capacity as an Aspen Shareholder (he gets paid pretty well too), when he travels on the company, it is a different story. Let me explain, I had heard that when he travels locally here, a two or a one hour flight from Durban to Joburg, Joburg to Cape Town or Cape Town to Durban, he flies economy class.

I heard from a client yesterday afternoon how she once saw Saad on a coach flight from Joburg to Cape Town (on a Kulula flight), helping fellow passengers load their luggage into the hold. And in a world that celebrates actors and sportspeople much more than business people, you could expect someone sitting next to Saad to ask what it was that he did for a living. When in truth, in his personal capacity, he could buy Comair (the operating company for British Airways and Kulula locally) eight times over.

Why is this important as a shareholder? It tells you that the founder, the CEO, one of the biggest shareholders, separates business from self. Something that politicians find incredibly hard to do. If it is not your money, then it is not your money. Even though Saad indirectly would pay 12.1 percent (as that percentage shareholder) of the seat on Kulula from Joburg to Cape Town (or anywhere on company business), he is well aware that the other shareholders are fitting the tab for the rest. That is the kind of person you want looking out for your best interests.

So, as we said yesterday, is Aspen expensive and more importantly, what do you get if you buy them now, at 340 Rand a share? You get the same smart management team (Saad and co.) and their ability to be able sweat acquired businesses much better than the prior management. Reducing costs, being able to identify ways of doing business cheaper, improving efficiencies, the Aspen way.

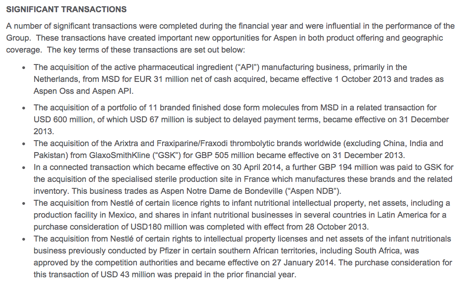

Not being afraid of letting businesses go that they feel are not core, teaming up with the likes of Mylan in the US for their anticoagulant drug (selling them, Mylan, the rights for the drug distribution in the US). As Paul said, there must be some sort of history, the drug is difficult to replicate as a generic with big successes. That is just one deal, from the release here are multiple deals that they did over a number of years.

The prospects column suggest that the businesses that have been bolted on will continue to make a meaningful contribution as they are finally in a full year of results, having started on the first of July 2014. They are going to look to sell aggressively, specifically Arixtra and Fraxiparine in emerging markets. Revenue will continue to ramp up heavily and as long margins are maintained at these levels, they will continue to be hugely profitable, able to service debt aggressively and most importantly attract a premium to the market.

If you are worried about the aggressive multiple, know that earnings expectations for next year see the PE unwind to around 22 times. As the company becomes mature (in a while seemingly), know that the dividend policy will change for the positive, for you the shareholder. In other words, once the debt is serviced for both historical and future transactions, the company will be more forthcoming with the payback to you. We continue to add to what is a quality business. Aspen is firmly in the top 15 of JSE listed companies, with a market capitalisation of 156 billion Rand (or 14.2 billion Dollars), but by global standards a long, long way away from being close to a major. In those leagues you have Glaxo, Merck, Pfizer, Roche, even by generics standards Teva is three and a half times their size.