Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

A whole lot more important for our client base and a company that has grown exceptionally quickly over the last decade is a business called Aspen. The company released results yesterday afternoon, the presentation to investors is today. Why own a company like this? Well, you know that healthcare is a key part of the investment makeup here at Vestact, the whole idea that more and more people are going to have access to formal healthcare over time and that is great for many businesses in that sector. We could have chosen the cheaper Adcock Ingram in that time. And why I say cheaper, from a fundamentals point of view, Aspen has always looked expensive. That is because they have managed to grow so quickly, they have one of the most extraordinary South African businessmen in the form of Stephen Saad at the forefront of the business.

Saad is of course the CEO, that is the role that he has had since January 1999, he is the founder of the business too. Remembering that he is only 50, he has not only achieved a lot, the road ahead is seemingly very long too. The deputy group CEO, Gus Attridge has also been around since the beginning, collectively the two of them own 16.2 percent of the business, Saad around 12.1 percent and Attridge owns 4.1 percent. At the closing price last evening, of 339 Rand, Saad, who has 55 132 421 shares was worth on paper 18.689 billion Rand. Or 1.711 billion Dollars. And Gus Attridge roughly one third of that. Those two started the business in 1997 together and have done more than most shareholders would have dreamed.

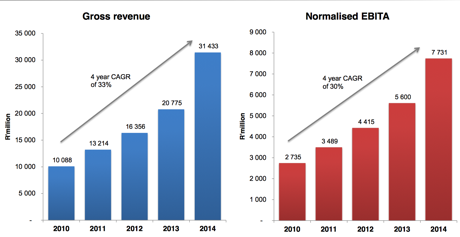

The business has grown in this regard, here is a screenshot from the results presentation:

Obviously all these transactions have dramatically changed the nature of the business, South African revenue is only 24 percent of the group, the rest of the continent is around 9 percent, one third of revenue and 28 percent of the normalised EBITA come from our continent. South African revenues barely budged. That is the main reason why Adcock are sucking wind, they do not have what Aspen have, the huge fast growing offshore businesses. So whilst this business has its roots entrenched in South Africa (Saad and Attridge still live in Durban), you can see that from the revenues and profits that it is not a South African business.

The reason why I underscored the management's age is that their hunger exists for deals. In the international slide in the results, Aspen suggested that they were still looking for growth opportunities through acquisitions. A massive footprint has been added in Europe, hence the giant increase in revenues for the year, 53 percent. You have to pay for this, and that is why debt has grown significantly, leading to funding costs of over 1 billion Rand in the last year. Net borrowings as at the end of the year was 29.8 billion Rand, roughly the same amount in debt as the group turnover. With group EBITA margins at nearly 25 percent, gearing of 51 percent is not too much of a problem, the business has incredibly strong cash flows.

With basic HEPS at nearly 11 Rand a share, 1097.9 ZA cents and the distribution at only 188 ZA cents, the price at 340 Rand seems expensive. But as mentioned above, these guys have always been "expensive". We watched Stephen Saad on the box yesterday and I think the biggest and most encouraging takeaway was that the deal making was not going stop. Aspen have strategically positioned themselves to buy non-core products and operations from big global pharma businesses. Stephen stressed that their ability to turn these businesses around at the lowest cost possible is what differentiates them from the others. Their implementation and efficiency is unparalelled. I am sure there is still a lot more fat left to chew off these big bloated pharma businesses. We continue to back this fantastic business.