Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received results from Steinhoff for the year ended 30 June 2014. As always is it is complicated. The financial review which covers all the moving parts is just as long as the operational review which focuses on the underlying businesses. Credit though must be given, once you read through the report it all makes sense and they simplify everything nicely.

Financial review

Revenues grew by 20% to R117bn while operating profits increased 29% to R12.6bn. Headline earnings from continued operations increased 40% to R9.1bn. Adjustments had to be made because of the partial sale of the KAP stake which then had to be excluded from continuing operations. All of this equated to Adjusted headline earnings per share of 479c. It all sounds great but the currency swings also played a big part for a business earning in Euros and reporting in Rands.

And corporate activity, it was a busy year, this is what they got up to. A JD group rights issue and the increased stake to 86% in JD Group. The partial sale of KAP shares. Refinancing of Steinhoff Europe. An inward listing of Steinhoff on the JSE with a dual listing Frankfurt (still to come). And then of course Steinhoff's own successful rights issue. As mentioned, lots of moving parts. And to top it all off they have sold the JD group book. This is great news in the current environment. The details of the deal were not given but should come in due course.

The share currently trades at R53 or 11 times earnings. It sounds cheap but it seems fair, the business is strongly geared with a debt to equity ratio 34%. But that is the nature of the business. Within that pool of assets sits R45 billion worth of property, predominantly in Europe so I wouldn't be concerned about the gearing.

Operational review.

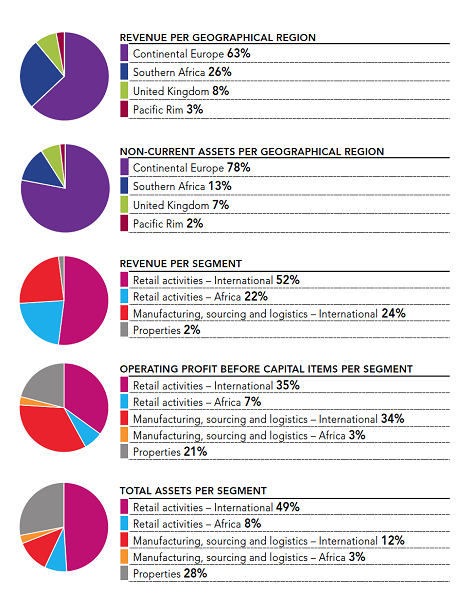

From the presentation I have hacked a few pie graphs which explains the business very well. As you can see this is very much a European story.

The commentary is assuring.

"In a year where consumer confidence in Europe showed some improvement, market share gains and margin improvement were prominent in the majority of the countries where we operate. The international retail operations continue to benefit from the group's growing purchasing power, group procurement initiatives and established infrastructure."

They are also making big investments to change the retail experience and improve marketing. Their online retail presence is strong. I think the actual businesses underpinning Steinhoff are in good hands and are doing well. Of course there is still lots of work to be done, especially with their South African assets but I am confident management will position themselves well for a turn in the cycle.

Conclusion

I think the share is fairly valued. It certainly offers value if all goes to plan but with so many things on the go there are risks. As Sasha often reminds us, remember when Steinhoff bid for JD Group back in March 2007? The timing would have been awful but luckily it fell through. If it hadn't we could be looking at a very different business today. I like the company, but not for the faint hearted.