Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Today we received half year results for the period ending 29 June 2014 from one of our favoured retailers Massmart. Let us look at the financial highlights first and then look at the divisional reviews.

"Total Group sales growth was 10.2%, with comparable sales growth of 7.1%. Product inflation was 4.8%, suggesting real comparable volume growth of 2.3%. General Merchandise's inflation increased to 4.7%, Food and Liquor's inflation increased to 4.5% and Home Improvement inflation increased to 5.3%. Sales in our African businesses represented 7.8% of total sales and sales in our continuing African businesses increased by 16.7% in Rands. Excluding foreign exchange movements, earnings before interest, tax, depreciation and amortisation (EBITDA) of R1.1 billion increased over the prior comparable period by 3.6%. Headline earnings and Headline EPS each decreased by 25.5% over the prior comparable period. Adjusting for the effect of the foreign exchange movements in both periods results in a decrease in headline earnings and a decrease in Headline EPS of 5.7%."

Now that sounds fairly complicated. Remember last year in the comparable period there was a big currency gain. Basically what happens is that the Massmart group will give a loan to for example Massmart Nigeria to open stores. It is very expensive to get a loan directly in Nigeria. The loan will be based in Naira but paid back in Rands. The movements between the two currencies create the confusion. This explains the awful trading update a few weeks back. We feel this should be communicated more clearly to the market.

Divisional Review

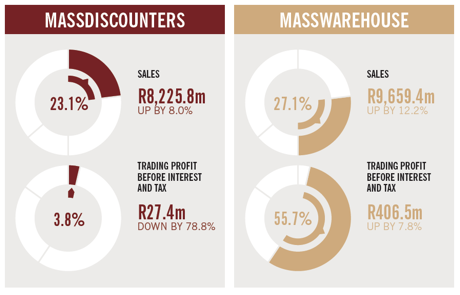

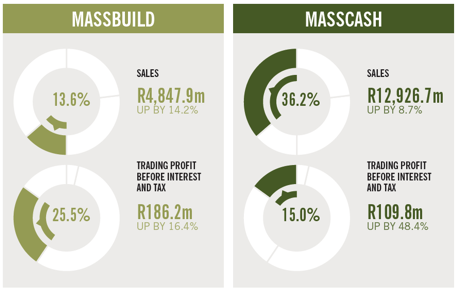

The images below set out the divisional breakdown.

Massdiscounters which compromises of Game and Dion Wired had a very tough period. Game is the dominant brand they are using to expand around Africa yet in South Africa comparable sales only increased 0.4%. We feel this part of the business needs a rebranding, change Game to Walmart for example. The FoodCo stores within Game seem to be doing well.

Massdiscounters which compromises of Game and Dion Wired had a very tough period. Game is the dominant brand they are using to expand around Africa yet in South Africa comparable sales only increased 0.4%. We feel this part of the business needs a rebranding, change Game to Walmart for example. The FoodCo stores within Game seem to be doing well.

Masswarehouse compromises 19 Makros. This is a great business with a great brand. Parking lots are full and the queues are huge. You can get absolutely everything in these stores and the retail experience is good. Sales increased 12.2% and I expect it to continue. As you can see from the image above these 19 stores are responsible for 55.7% of profits.

Massbuild compromises 93 stores trading under Builders Warehouse and Builders Express. Again great brands in an exciting sector. Sales increased 14.2% and profits increased by 16.4%. If Massmart just consisted of Masswarehouse and Massbuild we would be looking at a different picture. These brands target the higher income groups in South Africa which have been resilient to the current conditions. But diversification works both ways. When the cycle turns for the lower income groups they will be well positioned to benefit.

Masscash compromises 75 wholesale and 46 retails stores. This is a high turnover low margins business targeting the lower LSM groups. 8.7% growth in sales is commendable in the current conditions. Large focus should be applied to cost cutting here.

All in all after a closer look, the numbers don't seem as bad as they looked at face. I still believe in this model. There is no Home Depot warehouse type retail offering in South Africa and by extension many other countries in Africa. We continue to hold as they ride out a tough cycle for the local consumer.