Woolworths have reported numbers for the 52 weeks to end 29 June 2014. This is compared to the 53 week prior financial year, retailers just report that way! Sales increased on a comparable basis (the extra week is a benefit of 2 percent unsurprisingly) by 14.4 percent, adjusted profits before tax increased 20.1 percent. HEPS increased by 9 percent to 365.2 cents per share, strip out the transaction costs of 182 million Rand (David Jones and Country Road, as well as a currency loss of 139 million Rand) and adjusted HEPS (or aHEPS as they call it in the release) grew 17 percent to 398 cents per share.

The truth is that you cannot ignore currency fluctuations, sometimes they work for you, sometimes they do not. Nor can you ignore the associated costs of doing deals, nothing in life is free, perhaps the sea air, you would have to own the associated property and that is hardly cheap. The dividend for the second half of the year clocked 150.5 cents (127.925 cents after 15 percent tax), for the full year 251.5 cents, or 213.775 cents after tax. The dividend for the second half is not much changed from the 148 cents this time last year. At the closing price of 77.53 ZAR last evening the dividend yield post tax is 2.75 percent, the price to earnings multiple for those obsessed with the windy city is 21.2 times.

So why does the market give the company such a lofty rating? There are a few factors that differentiate Woolworths from their competitors, firstly their core customer is a little more recession proof and less price sensitive than their peer grouping. As such the company was both able to increase their gross profit margins in their clothing and general merchandise business and more importantly in the Woolworths financial services business the impairment rate grew from 3 to 4.8 percent, as the company points out, well below the industry average. In the outlook segment, the company sums it up better than I would be able to:

"We believe that economic conditions in South Africa will remain constrained, especially in the lower and middle income segments of the market where consumer debt levels remain under pressure. However the upper income segment in which we operate continues to show resilience. Trading for the first eight weeks of the new financial year has been positive."

Woolworths customers shop there knowing that whilst there might be a discount or two on offer for card holders,

they are there for the quality and as such (it sounds terribly snooty) not as price sensitive. As the company says and we all know, they operate in the upper income segment. South African middle and lower income groups are struggling with higher food and energy prices, overburdened by debt (I am pretty sure higher rates will impact on higher earners too), higher income groups will still be the core focus for Woolworths.

That is the core of the strategy in order to be able build a Southern Hemisphere retailer, the finalisation of the 12 percent of Country Road that they did not own and the David Jones purchase has meant more developed market and less developing market in the long run. The company says that the Australian market where consumers have had their own problems seems to be showing signs of improvement, expecting their own sales to be ahead of the market.

As a shareholder you must expect that there is going to be a rights issue, that has been telegraphed as one of the options of funding the expansion and the purchase of David Jones, 21.604 billion Rand, remember! The release suggests that you should stand by, further announcements will be made in due course, which is open ended, unlike Christmas which is only 118 days away!

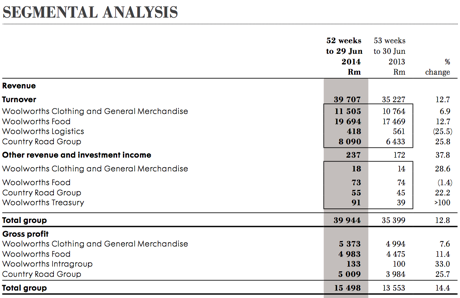

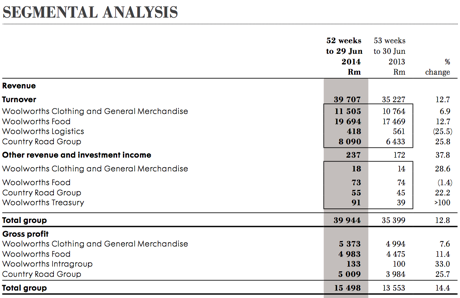

This graphic from the

final results presentation in the segmental analysis part shows you a few things, Country Road was both a much bigger revenue contributor and a much bigger profit contributor than last year. With the addition of David Jones the "international" segment should grow much bigger as an overall percentage, adding roughly another 19 billion Rand. Roughly 46 percent of revenues will come from down under. Obviously LOTS of work needs to be done in order to restore the profitability of David Jones to its former glory, Ian Moir and his team are tough operators with years of experience in Australia, it is not a new territory to them.

So what to do, if anything at all with ones Woolworths shares? Nothing, they are in a transition phase, stand by for the rights issue that is obvious of course, lower down in the release the suggestion is that next month (during the Southern Hemisphere spring, yay!) we should see an announcement.

Just a reminder of how Woolworths funded the David Jones acquisition:

"a combination of cash on hand and South African Senior Debt Facilities of R10 billion, a A$264 million (R2.5 billion) Australian Senior Debt Facility and a R9 billion Equity Bridge Facility." It is expected that equity bridge facility portion will be repaid with the proceeds of the rights issue. Quite quickly, back of the matchbox calculations, Woolworths market cap of 65.6 billion, they need to raise 9 billion, or roughly 13.7 percent of the current market cap. Easy enough to think that somewhere in the region of 15 to 17 new shares per 100 at a discount to the ruling price is in order. Not huge, not small either.

This is a business as I said that is transitioning to a southern hemisphere retailing giant, obviously catering for the needs of the wealthier and aspirational consumer. We continue to stay long what in our minds in the best quality retailer with a wealth of management experience. It is also pleasing to see the market give the thumbs up to the results.

After reading Bob McTeer's piece today, titled

Why Has the Texas Economy Outperformed?, I was more convinced that the differences amongst us and discussing it in a cordial manner was better than perpetual mud slinging. I for one can only hold my head in my hands when I see conflict, I just cannot understand it. There are deep rooted mistrust issues that exist between the Russians and the Ukrainians and in the Middle East amongst different groupings. I have just resigned myself to the fact that I cannot understand it all and hope a resolution is reachable at some time in the future.

Back to McTeer's piece, the points that he tries to make are that because of the measures that Texas has taken relative to their peers, they will continue to attract investments at the detriment of other states. The only comparison that I can make here locally is that when someone says what can the government do to alleviate the stuck economy, my current go to answer is less, not more. Do less in the economy, empower people to solve people problems. Human innovation almost always trumps slow lumbering and overreaching legislation. The more you tell people that they cannot do, the less they are likely to do. My two cents worth. Although as we all know, inflation has rendered a two cent coin useless, that phrase deserves a re-look.

So what to do, if anything at all with ones Woolworths shares? Nothing, they are in a transition phase, stand by for the rights issue that is obvious of course, lower down in the release the suggestion is that next month (during the Southern Hemisphere spring, yay!) we should see an announcement.

So what to do, if anything at all with ones Woolworths shares? Nothing, they are in a transition phase, stand by for the rights issue that is obvious of course, lower down in the release the suggestion is that next month (during the Southern Hemisphere spring, yay!) we should see an announcement.