Brett Proctor would say "Oh my word" in only the way that Brett Proctor can say it. Except this delivery has uprooted all of the stumps and rendered the batsman incapable of carrying on, in the same way that I remember a Dolphins batsman once limping out on crutches trying desperately to save a match, methinks or seems to remember that particular fellows surname was Lyle. In this case we are referring to African Bank which released a trading statement that disappointed like no other one of their recent statements could have before. To top it all off, CEO Leon Kirkinis resigned with immediate effect. The fellow has been there for 23 years and was one of the founders of the business, this is not Bradman with tears in his eyes because he could not see the ball, this is limping off after successive ducks in successive matches sadly.

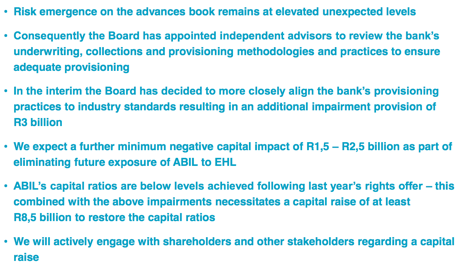

To add insult to injury the company needs to raise bucket loads of money again from their shareholders, who had a mere nine months ago paid in excessive amounts of money. There are two slides from the market update that deserve our attention, first and foremost the capital raising slide from the QUARTERLY TRADING UPDATE for the nine months ended 30 June 2014:

As an existing shareholder that last part means another massive rights issue. Now we have seen this before with businesses like Supergroup and Metorex, admittedly companies not in the business of money lending. How can the landscape have continued to deteriorate that badly in such a short period of time? We were led to believe that the management were taking the necessary steps to restore the business to something resembling normal in a tricky operating environment. Indeed the company cites several factors leading to the deterioration, in the operational performance of the SENS release the company tells you everything that you possibly knew already:

The Group continues to face tough trading conditions, against a deteriorating economic environment negatively impacted by lowered GDP growth expectations, increasing inflation, and loss of customer income through strike action and increased unemployment at 25.5% for the quarter ended June 2014, as reported by Stats SA. ABIL customers‘ disposable income and their ability to service debt continues to be under pressure, driven by a combination of above inflationary cost of living increases, higher relative debt servicing costs and lower growth in their gross income.

All true, we know most of this, some of the other big banks have taken their unsecured lending operations and tugged back sharply, most recently Nedbank have displayed this in their results. So who are the shareholders of this business, who owns African Bank? Well, you can see from their website:

Major shareholders that the PIC (beneficial ownership of 15.37 percent as at 31 March 2014) and Coronation with a little over 22 percent are the major shareholders here.

ABIL's BEE programs themselves have around 5 percent of the share capital. As you can see from the list Leon Kirkinis owns 22 million shares himself. Once ABIL was worth 40 Rand a share, a little over two years ago, now a mere 90 cents, with a low of 28 cents. Still pots of money in a South African context, but I am sure that will hardly make him feel any better, he has basically given most of his working life to this business, the long hours and the personal sacrifices would hardly feel worth it to him.

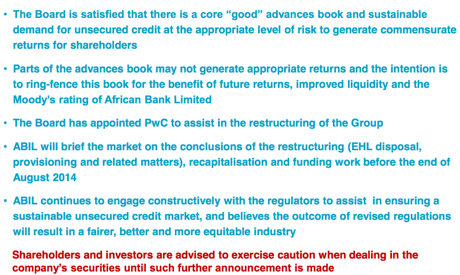

So what now for the company? The outlook sums it up, one of the slides from the presentation (link above):

What do you do and what are the likely scenarios at this stage? I guess that there are not only the equity shareholders and their issues to deal with, they are possibly likely to stand behind another large rights issue, the bigger issue becomes the bond holders (a roughly 50/50 mix between international and local holders) who could be carrying the can if the worst case scenario transpires, NOT something that either the government or the banking regulators would want, the economy is fragile at best.

Something needs to happen very quickly, of course the situation is pretty fluid. In other words someone threw in the towel big time today and the likely buyer of the stock were the shorts who have closed off at the feasting tables, I assume that there is still a large portion of the shares outstanding that are short the stock. The stock has been obliterated again this morning.