Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

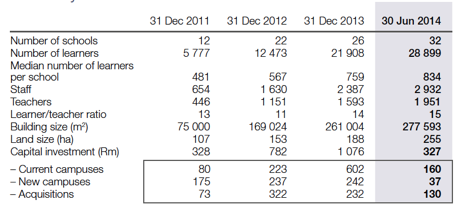

Yesterday we received 6 month results for the period ending 30 June 2014 from Curro, the biggest for profit private school education provider in South Africa. The presentation has lots of very informative tables so bear with all the figures being thrown at you. First lets look at the progress made as far as schools and learners are concerned.

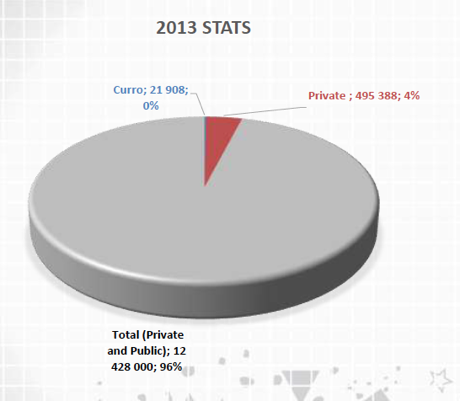

As you can see the ramp up of students has been aggressive in a small space of time. If that concerns you take a look at the pie chart below showing how much more room there is to grow. Curro are still a very small fish in a very large pond.

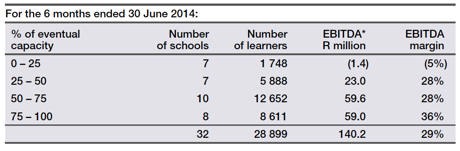

Ok lets delve into the numbers. Revenues increased 54% from R315 million to R487 million. EBITDA increased by 89% to R96 million which equated to headline earnings of R27 million. This equated to earnings per share of 9 cents with no dividend declared. As you can imagine predictability of earnings going forward is very difficult. Trading at R26.30 the multiple is huge but don't forget that this company has only recently become profitable. Talking about profitability this table was very interesting. It shows the kind of margins Curro receive at certain capacity levels. Incredibly at anything above 25% Curro are in the green pretty handsomely.

The future looks bright for Curro but as you can see the market already knows that. The share is priced for heavy growth. I wouldn't let that deter you though. There are still so many positives to take from this model. One of the those is the relationship they have with 57.5% shareholder PSG. I read in a Moneyweb article yesterday that the experts from PSG are actually the ones who are out their looking for expansion opportunities while CEO Dr Chris van der Merwe runs the day to day operations of the current business. That sounds like a fantastic relationship to me.

As you may remember they did a rights issue a few months back where they managed to raise R589 million. This wasn't their first capital raising through the market and won't be their last in my opinion. In 2014 they plan on investing R1.5 billion alone, that is nearly 20% of their market cap. By 2020 they plan on owning 80 schools (32 right now) but I honestly believe they will match this target before then. I like the theme, I like the management structure and I think the stock is a good investment. Not for the fainted hearted though, the ride is going to be interesting.