Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday evening we received first half results from L'Oreal. Overall like for like sales grew by 3.8% but due to currency fluctuations sales reported in Euros were down 1.7%. They have been hit by a double edged sword with the Euro strengthening amongst developed market currencies but at the same time many developing market currencies have weakened. For a company reporting in Euros this is of course not a good situation and explains why the share price has been flat for the better part of a year.

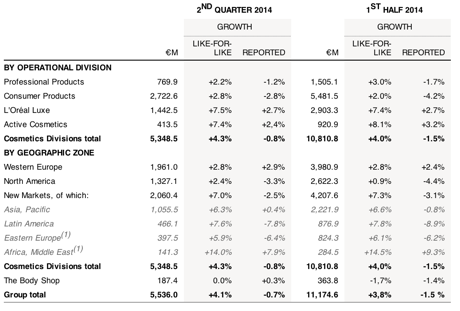

To kill many birds with one stone lets take a look at a table which lays out sales by operational division and Geography.

Here you can see all the currency effects, especially in the U.S and emerging markets. Wow this company is well diversified geographically. There is still huge growth potential in these regions though, especially in Asia and Africa.

Divisionally L'Oreal Luxe grew very nicely. That includes their top end makeup and perfume brands. Think Richemont and LVMH, the top end brands are very defensive and are soaring in this current environment. Active cosmetics which includes expensive suncreams and anti blemish products also did really well but is one of the smaller divisions. Professional products which includes products used at hairdressers and salons had a tough period thanks to slow growth in the U.S. Maybe it was the bad weather? I'd expect this division to pick up as that economy soars. Consumer products were solid but not exceptional as we have seen from competitors such as Johnson & Johnson and P&G.

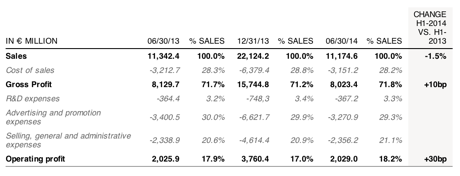

What absolutely fascinated me about this business was the margins and where money is allocated within the business. See the table below. 30% of sales is spent on advertising and promotion expenses! I am sure a fair sum of that goes to people like Scarlett Johansson and Blake Lively. Gross profit margins of 71% also shows you that these products are cheap to make but expensive to tell you how well they work.

Earnings for the year are expected to come in at 5.49 Euro which is enhanced by the big share buy back they have done with Nestle. We covered the details of that transaction in February in a piece titled Nestle make their intentions clear. The stock trades at 126 Euro or 23 times this years earnings which sounds about right for a business of this size growing like for like sales at such a fast pace. Any Euro currency weakness would also boost the share.

We continue to be attracted to the theme that L'Oreal are at forefront of, aspirations of new consumers. In fact Sasha tweeted a fascinating article the other day titled The "Next 15" will drive 80% of emerging market growth by 2025. Here is an extract. "McKinsey suggests that through mass urbanization there will be 60 megacities, double that of today, accounting for a quarter of global GDP. To target these areas of growth, luxury brands must adjust strategies to include cities that may not yet be on their radar to ensure that they have a presence as new†markets begin to flourish."

I guess that is what 30% of sales in marketing will be geared towards, targeting that new market. We are still very happy to be adding to this stock, especially considering the current share price weakness.