Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

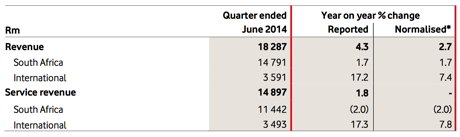

We skipped it last Thursday, there was too much going on at the time, rather late than never, here are the Vodacom Group Limited quarterly update for the period ended 30 June 2014. The table snapshot from the press release sums it up:

Clearly you can see that local revenue, South Africa at 80.88 percent, is still the lions share and unfortunately only growing at 1.7 percent. Why? In part interconnect rates having fallen and in part a fall off in prices of 25.3 percent (average price per minute is 68 ZA cents), the pickup in caller traffic (up 26.1 percent in outgoing traffic) however has offset that. Mostly however there was a surge in devices and accessories revenue which represents 21.4 percent of total revenue.

The company has invested a lot in infrastructure, adding a further 473 LTE sites and thereby increasing the fastest mobile internet infrastructure by 50 percent. Good work. Whilst data prices fell 30.3 percent per megabyte, traffic increased a whopping 70.1 percent. I can deduce that there are better and more expensive devices accessing more data as we converge towards the internet of everything, as Cisco term it. Data revenue continues to grow quickly and more and more South Africans are getting connected to the internet. There are now 8 million smartphones and tablets connected to the networks, with 17 million data users.

Data will continue to be the main focus. Whilst Vodacom still waits for ICASA and the competitions authority on the finalisation of the Neotel transaction (7 billion Rand for all of it, announced 19 May 2014), the offering to businesses is clear when Vodacom have their paws on the "other" fixed line operator: "The combination of Neotel and our existing fibre network and enterprise business will accelerate our unified communications strategy in addition to yielding substantial cost and capex synergies." I want faster and more reliable internet, we all do.

What next? Expect ARPU's to stabilise, I think we are close to the tipping point in terms of ARPU's starting to move higher. Calls are cheap, people are speaking more, data is cheaper, people are using more of it. Whilst Vodacom are going to continue to see their rest of Africa business move quicker and quicker ahead, it has a long way to go before picking up any slack offering here in South Africa.

Parent company Vodafone (65 percent holder) will continue to extract top Dollar, as a minority shareholder (alongside the South African government who own 13.9 percent), you can benefit from the superior dividend stream. The analyst community have the company on a forward dividend yield of 6.9 percent, the after tax yield is closer to 5.86 percent forward. For those who want to extract more by way of income, this is a good business to own in a low interest rate environment, MTN remain our top pick in the sector.