”Coffee is a great product. It is a socially acceptable stimulant that doesn't seem to have any long term negative affects. And it is delicious. The Starbucks coffee brand is by far the leader in the sector."

To market, to market to buy a fat pig. The firmer local currency to the US Dollar, which I think is a response to the weakening Euro. As such some of the heavyweight stocks in our markets have been under pressure over the last few days. Whilst that is not good for market levels overall, it is very good for you and I and the inflationary outlook. Much hotly debated amongst economists, our living costs and what the Central Bank can do. I am afraid very little in the face of economic policies that even insiders (of government) do not agree with, no clear pull together on the NDP can be seen. Well, at least from where I sit.

Over the seas and far away the S&P 500 eeked out a gain, the Dow Jones did not. The nerds of NASDAQ lost a few points, all in all it was an uneventful day. However there was one number, weekly jobless claims which had a 2 in front of it, 284 thousand, which was a 8 year low. Now an 8 year low is never great unless you are talking about fewer people applying for unemployment benefits. That means that the labour market in the US is looking better and better. A better US economy is good for the rest of the world.

Today there is the small matter of UK GDP, which will no doubt have a bearing intraday on the markets that operate inside of these times zones (we can count ourselves lucky in that regard) and a little later today in the US there is another small matter of US durable goods orders. More durable goods bought by the broader population almost always is an indication of a positive outlook. You would not buy a dishwasher or washing machine if your cash flow was limited over the coming months, as a result of you perhaps losing your job. No. You do not buy a big ticket item unless you are comfortable with the outlook.

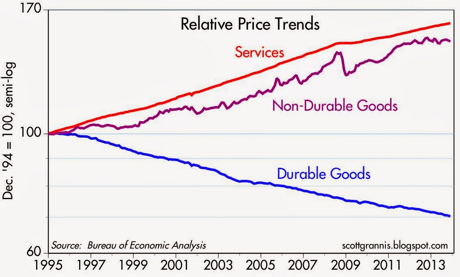

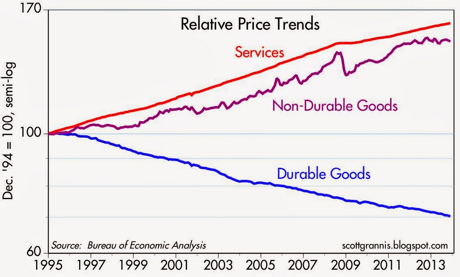

Here is what I mean, Scott Grannis from his blogpost last year titled

Amazing changes in relative prices had this magnificent graphic, in which you can see

as time goes on, on a relative basis durable goods get cheaper and cheaper.

A couple of interesting company announcements this morning, firstly from

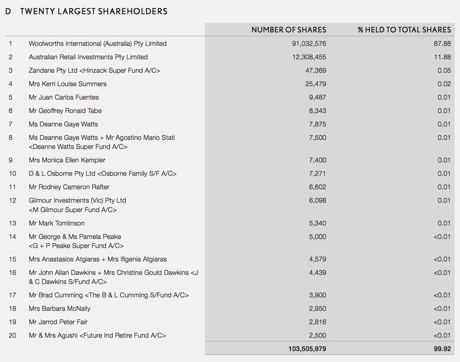

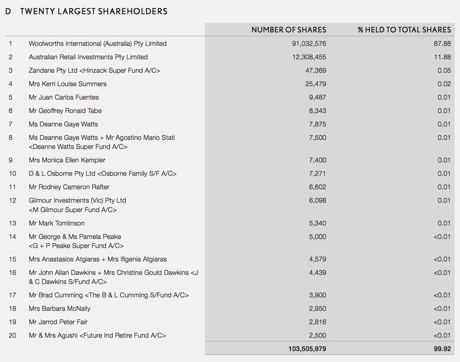

Woolworths in which the Australian Foreign Investment Review Board have okayed their takeover offer for the rest of Country Road that they did not own. Woolies owned (as per the release) on the 23 of July after market, 87.92 percent of Country Road. Who are these shareholders who are going to get bumped out? Long suffering it seems. I have to share this, from the annual report:

Brilliant. I love the fact that the small shareholders, who own small parts of the company get to be part of the shareholders list inside of the annual report. People like Mrs Kerri Louise Summers, who owns 25,479 shares. And Mr Juan Carlos Fuentes with his 9,487 shares. They are the fourth and fifth biggest shareholders collectively, owning 0.03 percent of the company.

More importantly for you as a Woolworths shareholder is that Australian Retail Investments Pty Limited (Solomon Lew), which owns 11.88 percent of the company, has accepted the offer from the South African company triggering the offer to minorities as you can see. Folks like Kerri and Juan Carlos. Another obstacle removed, Woolworths in the end got what they wanted.

Anglo American have released their interim numbers to end June this morning, to view the

interim presentation follow the link. Even if Anglo manage to make around the same as last year, 2.10 Dollars in earnings and pay the same dividend of 85 US cents (in a lower commodity price environment), surely there are better investment options.

Quick math, Anglo trades at 286.5 Rand a share, translate that into Dollars you get to a 13 multiple. However, the expectations are for the company to earn less than that, somewhere in the region of 1.8 Dollars per share, meaning that forward the company is trading on an earnings multiple of 15 times. I can buy BHP Billiton on less than that, their assets are better, energy is more attractive (to us) than diamonds and platinum. Plus the yield is hardly a kings ransom, 3.1 percent before tax compared to BHP Billiton yield of 3.5 percent. And as far as the turnaround, I suspect that is over 24 months ago. We continue to favour BHP Billiton over Anglo American and at these prices is in my view a sell.

Visa takes you places, or so the strap line goes. Visa has also taken their shareholders places, mostly always good ones. Why do we like this company? It is pretty simple, the investors relations landing page (do we still call them that) obviously describes the company better than I ever could:

"Visa is a global payments technology company that connects consumers, businesses, banks and governments in more than 200 countries and territories, enabling them to use digital currency instead of cash and checks."

Why would digital payments be better for everyone? Firstly it is safer for the user, there is no need to carry cash. Eliminating cash eliminates the need for expensive security associated with the handling cost. In South Africa we have seen the familiar sights of armed men in bullet proof vests standing thirty odd metres from heavily armoured trucks carrying money. No physical currency = lower security = cheaper banking costs. Consumer wins.

Checks are obviously a distant memory here, but are widely used in Europe and North America. Notwithstanding that there is relatively high check payment usage, the payment method is jurassic (hunting in packs and feathered apparently - another story) and dated. Doomed to extinction in my lifetime no doubt.

Lastly, the folks under most pressure for revenue collection, governments globally would love to see only electronic payments methods, there would be a trail. Not a paper one but a more easily traceable electronic one. Crime and cash go together, eliminating the use of cash would also be better for broader society too.

Ironically by owning Visa you are encouraging the usage of safer transfer methods and promoting compliance, doing good.

Doing good is one thing, investing your hard earned money and getting an acceptable return is more important to our readers as blunt as it may sound. We invest our money to make money. If we happen to do good alongside, that is an added bonus.

Is Visa a good company to invest in then? Let us first have a look at their third quarter results to end June 2014.

Net income increased 11 percent to 1.4 billion Dollars off of operating revenues of 3.2 billion Dollars. You do not need to be especially good at math to realise that is a fabulous margin business. On an EPS basis the company earned 2.17 Dollars. The quarterly dividend for the current financial year is 40 cents, US of course. Operating expenses fell 3 percent, margins expanded 300 basis points to 64 percent, that is fabulous.

The company during the period bought back 5.6 million shares at an average price of 207.13 Dollars, using 1.2 billion Dollars of shareholder money. That is over a percent of the shares bought back during the quarter, no mean feat. 3 billion in total this financial year, the company noted that they will buy more shares as they see fit. There is 1.9 billion Dollars available in the current share repurchase program, about 1.5 percent of the current market capitalisation.

There were some "issues". As per the conference call (courtesy of SeekingAlpha -

Q3 2014 Results Earnings Conference Call), from the prepared remarks of the CFO Byron Pollitt:

"For the June ending quarter, the sequentially downtick of 1 percentage point in cross-border was broad-based and spread across China, Russia, Ukraine, Venezuela, Argentina and the Middle East as you might expect, given political tensions and the early on-set of Ramadan."

Russia remains a problem not only for the company and the people that live there, but for all of us. The cross border transaction volumes were a 15 year low, some countries cracking down on externalisation of their currencies after precipitous falls. Byron has some juicy stories about the wonky economic policies in Argentina and how it leads to black market rates and official rates for the local currency. Sigh.

Digital payments, what about that? Who is going to be the winner in all of this? I suspect that Visa and their competitors will evolve to continue to process the transactions from the traditional physical to the digital world. On the conference call, CEO Charles Scharf, thanks again to SeekingAlpha and the above link. We have to thank them, that is part of the deal!

"First of all, there is a lot of clutter in the market about who is doing what in the digital payment space. It can be confusing for sure. We have a very specific point of view and a set of strategies here. Simply put we are keenly focused on achieving the same success in the digital world that we have had in the physical world. .... As in the side our card not present volumes today are growing three times as fast as card present which we feel is still just a fraction of the opportunity in this space."

The company is enabling many more partners. Visa is opening a innovation center in San Francisco to enable new and old partners to sit side by side to promote and create payment methods. They are investing in smaller companies to help them keep up with innovation. Visa Checkout is more easily usable on both mobile and web through newer published APIs and SDKs. Huh? An API is an application programming interface. A SDK is a software development kit. Electronic payments through ecommerce, Visa being one of the preferred payment technologies.

The guidance given was a little lighter than the market anticipated, hence in the after hours the shares pulled back 3 percent.

This is an opportunity to buy more of what is one of the best investments out there with huge growth potential even in developed markets. Buy.

I want to add something here. Statistically speaking, flying is still safer than any other method of transport. There is however a fascination with aeroplane crashes, I guess because they are not supposed to happen. I read a Bloomberg story this morning that suggested that over 100 thousand commercial flights take place each and every day. Our expectations are for each and every one to arrive. Read the press release from Iater yesterday:

Statement from Tony Tyler on Tragic Week in Aviation in which he said:

"In 2013 more than three billion people flew and there were 210 fatalities."

I then downloaded this report from the World Health Organisation:

Global status report on road safety 2013 In which they say:

"eighty-eight countries have reduced the number of deaths on their roads - but the total number of road traffic deaths remains unacceptably high at 1.24 million per year."

And then even more worrying:

"only 28 countries, representing 449 million people (7% of the world's population), have adequate laws that address all five risk factors (speed, drink-driving, helmets, seat-belts and child restraints)."

After having read that you should be afraid to get into your car. Unfortunately the opposite perception is created by almost everyone. Nuts if you think about it.

Byron's beats

Last night we received Q3 results from one of my favourite companies listed in New York, Starbucks. Before we delve into the numbers here is an extract from an article I read titled

3 reasons it's hard to hate Starbucks.

"Five years ago, Seattle-based coffee chain Starbucks wasn't in a good place. In its fiscal 2008 annual report, the company showed a 3% contraction in comparable store sales, a bitter piece of punctuation following three consecutive years of sales growth deceleration. This is no exaggeration. By the end of 2008, Starbucks stock was trading below $10, less than half of where it was at the end of 2007 and well below its 2006 peak of just above $35. Investors apparently wanted nothing to do with a company whose business is predicated on premium coffee and free Wi-Fi."

If you read the article it goes on to explain how Howard Schultz, the well known CEO, turned the business around by investing in the employees and the people of Starbucks. He really is one of the best CEO's out there, in the league of Jeff Bezos, Steve Jobs and Warren Buffett in my humble opinion. Read the article, it is very insightful.

Fast forward to 2014 to a record third quarter with sales growth of 11%, comparable stores sales growth of 6%, operating income growth of 25%, operating margin expansion growth of 2% to 18.5% and earnings per share growth of 22% to 0.67c. The company opened 344 stores in the quarter with a total of 20863 stores. Compared to McDonalds with 350000 there is still a lot of room to grow. This is the 18th consecutive quarter of same store sales of more than 5%.

So what are these guys doing right? Firstly coffee is a great product. It is a socially acceptable stimulant that doesn't seem to have any long term negative affects. And it is delicious. The Starbucks coffee brand is by far the leader in the sector. The Nike or the Apple of the coffee world.

But for Starbucks the innovation in other sectors is really exciting. Teavana which is a fine tea and tea bar concept endorsed by Oprah already has over 360 stores. Breakfast sandwiches grew by 40%, baked goods are flying and they have big plans for the lunch market. The business is also experimenting and succeeding with online retail. The Starbucks app allows you to order online before you pick it up as well as do the payment through the app. Here is what Howard Schultz had to say about the quarter.

"Starbucks Q3 represents another quarter of outstanding operating performance in which each of our segments contributed to record results. The increasing power of the Starbucks brand, the success of our best-in-class mobile, social and digital technologies and our greatest asset - over 300,000 partners who deliver the Starbucks Experience to over 70 million customers around the world each week - position us to continue growing our business around the world and into the future."

As you can imagine, the stock is not cheap, earnings for the full year are expected to come in at $2.70. Trading at $78 or 29 times earnings a lot is expected from this company. But with earnings growing around 20% and sales expected to grow 10% for the next few years you can see why. The company expects to add 1600 new stores just this year.

Another huge potential growth factor is the geographic spread. At this stage the US and Canada is still responsible for 75% of sales. Even Europe is less than 10% of sales. The opportunity to expand what is already a global brand to areas where they do not have exposure is there for the taking. South Africa is a prime example. We love the theme and we back management to continue to grow from what is actually still a low base.

We continue to add to this stock.

Home again, home again, jiggety-jog. Markets are marginally higher here, a moderately weaker Rand coupled with firming commodity prices see the resources complex move higher.

Sasha Naryshkine, Byron Lotter and Michael Treherne