Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

BHP Billiton have released their production report for their full financial year to end June 2014. Iron Ore production at a record of 203.564 million tons, the quarterly run rate suggests annual production of around 225 million tons. i.e. If the company were to maintain the last quarters performance, from an Iron Ore point of view.

For the next financial year the company is expected to ramp up to 245 million tons. I have seen suggestions that BHP Billiton breaks even at 53 Dollars per ton, according to a FT article that cites research done by UBS -> BHP mines record level of iron ore. The iron ore price currently 92.74 (all grades) as per the end of June. That follows from 114 Dollars a ton this time last year, but the price has been as high as 137 Dollars per ton during the year.

The average price of Iron Ore over the last 12 months has been around 122 Dollars per ton, but remembering that production was ramped up in the second half of the year where prices averaged 112 Dollars per ton. So obviously the volume increases do offset the prices and the margins remain elevated, if not as much as before. The average selling price that the company received for the full year was 103 Dollars. So what to expect from here is for the iron ore price to find a level. Chinese steel demand remains key to the equation and this is (whether one likes it or not) the most profitable business that BHP Billiton have. Guidance, as mentioned before is for a 11 percent increase in volumes for the 2015 financial year, which is almost a month old now.

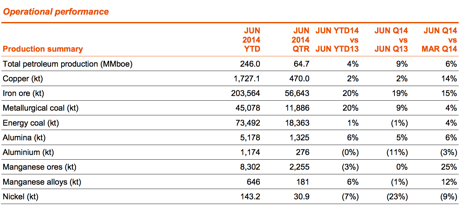

Total petroleum production, per barrel equivalent was a record 246 million barrels. In fact, rather than trying to spell it all out, let me take both the production table, which appears here:

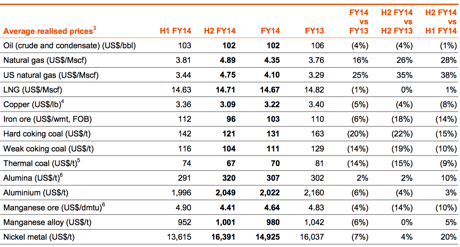

And then I will take the average prices for all of their products:

As you can see across the commodities complex prices fell. A company like BHP Billiton has little control over the majority of these prices, what they have control over is the cost of their various businesses and more importantly recognising which projects to pursue and which ones not to pursue. The obvious examples are the ramp up of the Pilbara iron ore project and onshore gas in the US. The obvious examples of assets that they own which they have not pursued as hard as we would have thought have been the potash project in Canada. No doubt that will come, with the Russians keeping a lid on prices, do not expect anything any time soon. Slow steps.

It is our core holding in the commodities complex, there is good diversity across the business, both geographically and products. Most importantly their capital allocation has been better than their peers and management is cautious, not really in the miners role. They are the biggest in size and scale and we should be so lucky that we can buy them here, as a result of historical reasons.

We are not active buyers of the company at present levels, nor are we sellers, we believe that if you held them historically they are bound to reward you handsomely with a greater dividend stream, last year the company paid 116 US cents, expect more this year, with the interim dividend having been 59 US cents already. I guess that means that the stock is currently trading at levels that you would call a hold, even though I dislike that term.