Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week we received second quarter results from Stryker. We have written about them before but here is a brief reminder of what this $30bn market cap company does.

"Stryker is one of the world's leading medical technology companies and together with our customers, we are driven to make healthcare better. The Company offers a diverse array of innovative medical technologies, including reconstructive, medical and surgical, and neurotechnology and spine products to help people lead more active and more satisfying lives. Stryker products and services are available in over 100 countries around the world."

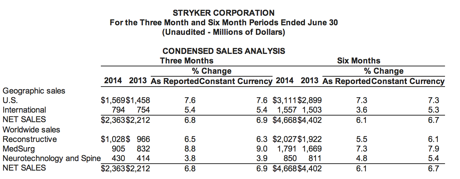

To make things even more clear, here is their sales mix. It breaks down which divisions make what and where they make their money geographically. Below the table I have added an image which explains what is entailed within the divisions. Unless you are a medical doctor a lot of this will sound like Latin but you get the picture.

Now that you know exactly what the business does lets look at the numbers. Net sales increased 6.8%. If you look at the table above you can see where sales are doing well and where things have slowed. But for a company predominantly operating in the US, sales growth of 6.8% is very impressive. The company and the whole sector in fact have been very active with M&A. 2.1% of Stryker's sales growth was from small acquisitions they've done recently.

Earnings did not grow as fast as sales which is against the trend of what we have seen so far this earnings season. Diluted earnings per share were flat thanks to some recall charges, acquisition related costs and some legal charges. The adjusted $1.08 that they made per share was in line with consensus and tees Stryker up to make an expected $4.76 for the full year. 2015 earnings are expected to grow a solid 10.7% to $5.27. The share currently trades at $81.6 which equates to 17 times earnings. It's not cheap but it certainly isn't expensive.

The company has exciting prospects ahead. I'd expect to see more acquisitions as bigger players like Stryker consolidate. The fact that they are still very much a US company means that international expansion is a big opportunity. In fact they even have a website here in South Africa where you can view and order products. The overall theme of healthcare supply speaks for itself. People will get older and richer and Stryker will be there to supply the essential equipment to remain mobile for longer. We continue to accumulate.