Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Quite an interesting way of going about it, the cat and mouse between government, the ruling party, the ANC and Anglo American taking place. Right now and of course over the last two decades, mining has been at the centre of our economy for a long time, Johannesburg was founded as a result of gold mining activity. A province to which nearly 13 million South Africans call home was largely unpopulated 200 odd years ago. Mzilikazi, the founder of the Matabele kingdom made these surrounds his home for a while, but the travelling boers defeated him and forced the Ndebele people north to modern day Matabeleland, a province of Zimbabwe. History is by its very nature ruthless and often tells the story of the victor.

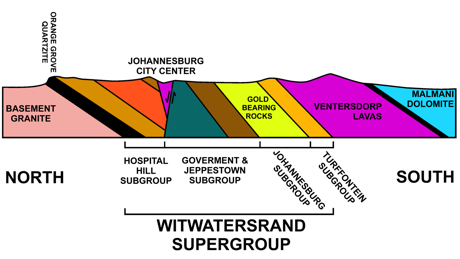

There is nothing glamorous about our province, sure if you have money here it is nice to live, the weather is predictable. You may or may not know, but Johannesburg is according to Wikipedia the "world's largest city not situated on a river, lake, or coastline". No gold equals no real settlement, the city was founded as a result of a gold rush. Today the province and city have fewer reminders than in years gone by, although 40 percent of all the gold ever mined and 50% of the world's found gold reserves are from South Africa. Just quickly, check this cool cross section I found from Wiki of the Witwatersrand.

That unfortunately is history. The country has undoubtably a better infrastructure and more advanced capital markets as a result of the exploration of minerals, you just need to cross the borders into the continent to see that. Our economy might be only the second largest in Africa now, after Nigeria, but the infrastructure is pretty decent. Although, as ever, more can be done.

Where am I going with all of this? Well, Anglo American have been told that they should not sell their platinum mines, it would be bad for the countries image as an investment destination. That is all very nice, but as the pockmarked south, east and west Joburg countryside can attest to (mine dumps), the mines are only as profitable as you can get the stuff out the ground at. In other words, if it costs you 101 cents to get something out the ground that you sell for 100 cents, you won't not only avoid doing this for very long, but you are not going to invest in the infrastructure. I understand where the ruling party comes from, from a investment destination point of view, but reality is a horrible, horrible thing.

If you cannot operate because the mine is unprofitable, it is not going to happen for very long. We only have to wait two weeks today to see, Amplats results which will no doubt reveal some reorganisation of the assets.

At the same time, Anglo have announced that they would be selling their noncore 50% interest in Lafarge Tarmac to Lafarge for a minimum value of £885 million ($1.5 billion). Or, around 4.2 percent of their market cap in Pound terms, which at Friday's close was 21.14 billion Pounds. So, this is neither a huge deal, nor a completely small one.

A number of conditions need to be met, including the merger between Holcim and Lafarge, which is obviously far more important for those two. Those two are currently working hard with regulators (more government intervention), trying to shed around 5 billion Euros in assets before the two are from a regulatory point of view allowed to merge. It is complicated, but in the end, should this Anglo sale go through, I would think that this is good to shareholders, this business was always noncore to the group.