What is going on with Steinhoff? A late announcement on Monday and the headline read Steinhoff announces secondary offering of shares in KAP Industrial Holdings Limited. Steinhoff offering institutions a discount in a book-build for 400 million of their KAP shares, thereby reducing their stake in the company to 45 percent from 61.8 percent. If you recall, Steinhoff quite simply have taken their South African assets and injected them separately into KAP and JD Group.

January 2012 -> Steinhoff looking to take control of JD Group. What happened is that Steinhoff gained control over both JD and KAP:

Steinhoff swapped their PG Bison, Unitrans and Steinhoff raw materials business in return for "1 912.8 million (new) KAP shares at R2.50 per share", that announcement was on the 18th of October. "And .... KAP credit(ed) a loan account in favour of Steinhoff in an amount of approximately R4 139 million"

So they, being Steinhoff used KAP shares to pay for a control premium in JD Group, reduced their stake in KAP from 88 to 61.8 percent (back then) and all the shareholders agreed that was a wonderful idea.

Fast forward to June of 2014. So now Steinhoff International are selling down their KAP stake and taking a full go for the rest of JD Group. After the rights issue, where JD Group shareholder stumped up another 1 billion Rand, Steinhoff now own 86.19 percent of JD. Not quite the 98 percent that they are looking for. For the record, on Tuesday the 400 million shares were sold at 3.85 Rand a share. So, Steinhoff extracted 1.54 billion Rand from this deal. Steinhoff injected their industrial assets into KAP in exchange for 1.9128 billion shares at 2.5 Rand a share. 400 million sold now at 3.85 Rand a share around two and a half years later. Sounds like a decent return in a short period of time.

Inside of the announcement, the KAP announcement of Steinhoff International selling their stake, was a one paragraph that could have huge implications for shareholders. Here goes:

"Steinhoff also announces that it has received formal approval from the Financial Surveillance Department of the South African Reserve Bank within the framework of the Exchange Control Inward Listing Rules, to seek a listing on the prime standard of the Frankfurt Stock Exchange. Steinhoff intends to commence with the listing process as soon as possible, subject to prevailing market conditions, after the release of its 30 June 2014 audited annual results in early September 2014. Once the Frankfurt listing has been implemented, Steinhoff will continue to be listed on the JSE Limited ("JSE") through an inward listing. The Bookbuild will support the preparation for the proposed Frankfurt listing of a focused retail group."

What?

First of all, what is an inward listing? Inward listings by foreign entities on South African exchanges is explained via the Reserve Bank piece. The headline however tells you that this applies to foreign entities on South African exchanges. What Steinhoff are looking to do here is almost the exact opposite of what Glencore Xstrata did last year. Or is it? When that announcement was made it was a secondary listing. So that is not an inward listing. So that would not be an inward listing. The Reserve Bank have a segment on

Inward listings. It is still as clear as mud to me.

I think for the purposes of trying to understand why Steinhoff have applied to do this is simple. The business as it exists now, post the Conforama purchase in March 2011 and reshuffling of South African assets in 2012 and now again this year,

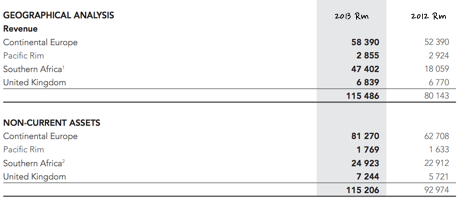

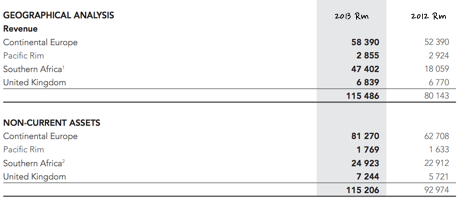

the rump of the business is no longer South African. As per the 2013 Annual report, you can see the evolution of the business from a small company here to a giant company with global operations. At the last results, 55 percent of their revenue was derived from Europe, 6 percent from the United Kingdom, 2 percent from the Pacific Rim and the balance, 37 percent, from Southern Africa.

On an assets basis however they are not a Southern African business. They (Steinhoff) quite possibly picked up Conforama for what was a generational low in asset prices in the developed world. Check the re-rating that the European assets have got over the last 18 months or so:

What has happened is that this business has become a European one.

What has happened is that this business has become a European one. And as such wants their principal listing to be in Frankfurt. Not just any listing, but a prime standard listing, follow the link for more information from

the Frankfurt exchange, prime standard. I have no way of knowing what the nitty gritty details, if you can still own them here, then why worry about this? What could happen though next is important for existing shareholders. More German and European investors looking to own another business with a developed market platform and a developing world presence. That might be very attractive for European investors.

It is hard to get to grips with the furniture sector, in the US there are no big listed businesses and equally I cannot find any across Europe, many of them seem to be private businesses, family owned. Businesses like Ikea, which itself has enormous history and is the only furniture business, in the world, that is bigger than Steinhoff International. Ikea has revenues of 28.5 billion Euros, profits of 3.3 billion. There is a VERY long way for Steinhoff to go to get close. But they have laid down their marker and investors may just give this company a higher multiple than they currently are afforded by the market. Sadly this means that the high energy team at Steinhoff has taken the view that their empire belongs in the old world and not here. But hey, you can still buy the shares, and there are extra buyers who will no doubt want the shares.