Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received full year results from high flying retailer Mr Price. Wow, these guys deserve all the money they make. They have done fabulously well through good times and bad. Revenues increased 15.2% to R15.8bn. Headline earnings per share were up 22.4% to 715c while the dividend was increased by 21% to 482. The company has now achieved a 28 year compound annual growth in headline earnings per share of 23.4%. The share price has grown 27.1% on an annual basis since listing.

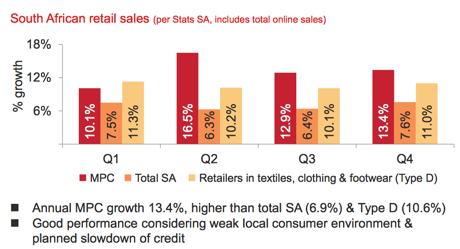

The share trades at R165, 23 times earnings at this price. Expensive yes, but do you blame the market for affording such a premium? In fact growing earnings at 22.4% puts the stock on a PEG ratio of 1. One of the main reasons for their growth this year was interestingly price increases of 9.7%. Due to the quality of their goods they are able to charge a premium and people are willing to pay it. I guess for me the below image is the kicker. Mr Price have managed to get the mix between price and quality perfectly and have therefore stolen market share. As you can see they have comfortably grown above the market.

Divisions.

The report summarises it all very well.

"The Apparel chains increased sales and other income by 17.0% to R11.4 billion and comparable sales by 11.9%. Operating profit grew by 21.7% to R2.1 billion and the operating margin increased from 18.3% to 19.1% of retail sales. Mr Price Apparel opened 24 new stores and recorded sales growth of 18.9% (comparable 13.0%) to R8.6 billion (56.4% of Group sales). Mr Price Sport recorded sales growth of 14.2% (comparable 6.5%) to R962.4 million and Miladys 7.0% (comparable 7.2%) to R1.4 billion. The Home chains increased sales and other income by 10.2% to R4.2 billion with comparable sales up by 7.3%. Operating profit rose by 20.2% to R590.6 million and the operating margin increased from 12.9% to 14.0% of retail sales. Mr Price Home increased sales by 10.5% (comparable 8.2%) to R2.9 billion and Sheet Street by 8.9% (comparable 5.4%) to R1.3 billion."

As you can see all the divisions are doing well. I find it amazing that the home division has managed to grow so nicely in a sector where the likes of JD Group, Ellerines and Lewis are really struggling. Even when you dig into the retails sales released by Stats SA you can see the sector is struggling.

Prospects are also exciting as the company plans to grow its online retail platform as well as expand stores both here and north of our borders. All in all a great set of numbers. We do however prefer Woolies in the sector, we feel the management are on a par but Woolies have further diversification with the food stuff. Their global reach is also a *nice* to have.