Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received full year results for the year ended 31 March for the business we know as Mediclinic. Now this one has been on our shortlist for a while. Lets take a closer look at these results and see whether this company fits the Vestact standards of investable businesses, which we like to think are very high.

First lets look at what they do. Here is a simple explanation from their website.

"Mediclinic is a private hospital group with three operating platforms in Southern Africa (South Africa and Namibia), Switzerland and the United Arab Emirates. Its core purpose is to enhance the quality of life of patients by providing cost-effective acute care specialised hospital services. Today Mediclinic Southern Africa operates 49 hospitals throughout South Africa and three in Namibia with more than 7000 beds in total; Hirslanden operates 14 private acute care facilities in Switzerland with more than 1 400 beds; and Mediclinic Middle East operates two hospitals and eight clinics with 382 beds in Dubai, United Arab Emirates."

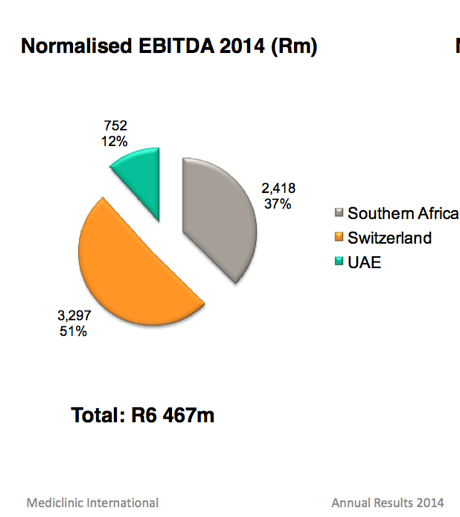

So we can see that they are not just a South African business. In fact far from it. Here is a pie chart of their Earnings. The Revenue chart is almost identical, margins in developing markets and developed markets don't seem to vary much. More on that later.

Now that you know more about the business lets take a look at the financials. Revenues increased 24% to just over R30bn. This equated to normalised profits of of R6.4bn or 377c a share. The share trades at R81 or 21 times historic earnings.

There are a few things here that need to be considered. The weaker Rand to the Swiss Franc was certainly a positive. Earnings from the Swiss business were up 28% in Rands but only 8% if normalised to Swiss Francs. If the Rand strengthens that will of course reverse.

The company also has a large debt burden. Close to R30bn in fact. Very big for a company with a market cap of R65bn. The debt comes from the acquisitions they did in 2006 and 2007 in the Middle East and Switzerland. In hindsight they could have definitely got the timing better but these assets are certainly bearing fruit. The Hirslanden (Swiss acquisition) cost them 2.5bn Swiss Francs at the time, R4.5bn of that raised through a rights issue. Fortunately that debt is still in Switzerland attracting Swiss Libor + 2%. A quick Google search tells me that Swiss Libor overnight rate is currently at -0.006% so you get the picture, it is cheap to borrow money there. That debt however had to be refinanced in 2012 which required another R5bn rights issue. It's been a long road. Take a look at the share price, thanks very much to Google Finance. As you can see it did nothing between 2006 and 2010 but from there, well the graph speaks for itself.

Is it too late to buy this stock? You know our view about healthcare, we think that as an investment theme, it is one of the most important of our time. Their geographic mix is very favourable and is a great Rand hedge. The dynamics between developing market and developed market health care is very interesting. Healthcare in the developed world is far from mature because the populations are so old and getting older. Old people need healthcare and as you can imagine, this is made a number one priority. The capex requirements for hospital groups are very high because standards are so high. Return on invested capital though are more than satisfactory, far outweighing investments in their own business.

In South Africa (developing) we have a fast growing middle class. This means more people can afford private healthcare. Our medical aid schemes are also extremely well run which has been a huge benefit for the hospital groups. However wages are an issue (over 60% of Mediclinic's expenses) because Doctors in South Africa require internationally competitive wages to prevent them from working elsewhere. This means that margins in both regions are similar (I consider the UAE developed) and both have pros and cons. For me the pros in both regions outweigh the cons but I am very happy that the majority of the business is outside SA.

It is a well managed business with a strong shareholder (Remgro own 43.4%) in a fast growing sector. There are regulatory risks in all the regions they operate in but I get the feeling that cooperation with governments will reap huge benefits. They provide such a vital service, in big enough scale, that government almost have to align themselves with the business as apposed to take them on, think implementation of National Health Insurance. The Hospital industry is also very fragmented, the biggest one out there is HCA which has a market cap of $23bn. This means that there are plenty of acquisition targets for a big operator like Mediclinic to consolidate once their debt levels come down a bit. All in all Mediclinic ticks all the boxes, we begin accumulating.