Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

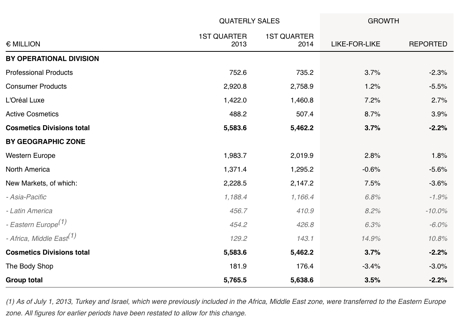

Last week we had first quarter sales numbers from L'Oreal. Here were the highlights. Like for like sales were up 3.5% whilst reported figures were down 2.2% because of big currency swings. As you can imagine, the Euro has strengthened considerably and this has a negative impact on a business who operates internationally but reports in Euros. Divisionally and geographically this table tells the full story.

Ok lets delve into the numbers from the above table. Consumer products, which includes the lower end hair products like Garnier as well as mainstream make-up products like Maybelline, had a slow period. This is on the back of a high comparative period in the US last year where they had big promotions and specials for these products. Consumer products contribute 50% of sales so this clearly had a big impact on the overall number.

Professional products which includes products sold and used at Hairdressers and salons had a good period. Here is what the company had to say about the division.

"The Division is growing in all zones. In the mature markets, the countries of Southern Europe have returned to growth. In the New Markets, the Division remains very dynamic. The main contributors to growth are the United States, Brazil, Russia and India."

The Luxe brands which is their high end stuff had a very encouraging period thanks to strong signs from Western Europe and growth areas like China and Travel retail. This is 27% of sales and has strong margins, a good sign for earnings.

Geographically their mix is extremely well balanced. Europe is their main market but the New markets segment all together is the largest sales contributor. As you can imagine, Europe was the least affected by the currency swings. Look at the growth coming through from the Middle East and Africa. More liberal stances from the Middle East will of course improve these sales off a low base. Lets hope for more of that.

I am happy with these numbers and so was the market, the share was up 3% on the day. I think mostly on the back of those strong Luxe brands sales. We continue to like this one because of the underlying business but also anticipate potential upside because from corporate actions. More when the results come out.