Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

But today, it is all about this. And wow, this is huge! Woolworths are looking to buy Australian retailer David Jones. Davey Jones and their locker, lock stock and barrel. The price tag? 4 Aussie Dollars a share or around 2.1 billion Aussie Dollars, which translates to 21.4 billion ZAR, as per the release -> Proposed Acquisition by Woolworths Holdings Limited of David Jones Limited and Cautionary announcement.

The effective exchange rate is 9.95 ZAR, the premium is around one quarter as to where David Jones Limited was trading. Merger talks between David Jones and Myer (another Aussie outfit) were terminated Monday. But I guess that the Myer offer was less compelling. But forget about that, this is sizeable, relative to the Woolworths market cap. 62.2 billion ZAR is the Woolworths market capitalisation at 73.47 Rand a share, where it closed last evening. The proposed deal is 34.4 percent of their market cap. Big.

So how does Woolworths propose funding this deal? Existing cash, new debt facilities and a "an equity bridge facility" that will be repaid by an underwritten renounceable rights offer. That means YOU, the shareholder will have to put extra money into this business in order to own David Jones Limited, at a specified price. I always wanted to be a pirate! It is not easy I guess to work out immediately, what the quantum of the rights issue will be, but perhaps the answer lies in the existing debt facilities, what the company is comfortable with from a gearing point of view and what the current cash reserves are.

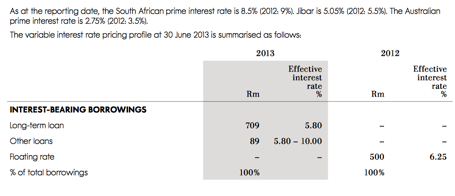

Cash and cash equivalents as per Woolworths interim results was 1.927 billion Rand. Dividends paid last year, as per their annual report was 1.64 billion Rand. I am not suggesting for a second that the company are going to suspend their dividend payments, but it is an avenue that could be explored, lower dividends for the time being. The company, as per the 2013 annual report has un-utilised banking facilities total 3.025 billion Rand. Non-current (being longer than 12 months) interest bearing borrowings were "only" 705 million Rand. Current interest borrowings (to be paid inside of 12 months), as per June 2013 was 127 million Rand. So, you could argue that Woolies are relatively un-geared. But still, this is going to be big, the company is going to need to raise serious money. But find this screenshot grab, from the 2013 annual report, because the lines at the top are important.

Why do I think that little line, "The Australian prime interest rate is 2.75% (2012: 3.5%)" is important? Well, with a substantial business in Australia currently, Country Road contributes 20 percent to the overall Woolworths profits as at the end of December, and for the half year profits grew to 471 million Rand. Obviously there were some positives from a currency translation point of view, but the business is very profitable and has a big presence, 136 Country Road stores as at the end of June 2013. 93 Mimco stores and 13 Trenery stores Down Under. More in South Africa actually, Trenery specifically, there are 25 stores. Witchery, there are 172 stores in Australia.

I think that they could raise money Down Under and here, a combination and use lower interest rates in Australia as an opportunity to acquire this business. There are obviously going to be costs involved with regards to the bridging facilities, the rights issuance, debt funding and so on, but that is life. So my conclusion on the funding part of the transaction is that the rights issue might not be as onerous as one might think. Perhaps a 2-2.5 shares for every ten that you own now. I guess that is not insignificant at all, but because there is a time line here, we have to wait. We should know everything, including the shareholder votes and various regulatory approvals, as per the release, from Woolies shareholders in mid June, David Jones shareholders in late June, the various law makers in late June to early July, with the deal expected to be implemented (money in the till for David Jones shareholders) in the middle of July. That is roughly 95 days away.

A few things as to why Woolies wants to own this business. For starters, Ian Moir (the Woolies CEO) is in his 16th year in retail in Australia, although strictly speaking he lives here. He joined the Country Road board on the 23rd of October 1998. So if anyone knows Australian retail, it is most certainly Ian Moir. What I found quite amusing is that Gordon Cairns, the chairman of David Jones was on Bloomberg Television (inside of a mall) earlier and he sounds Scottish to me. As is Ian Moir. Cairns has an MBA from University of Edinburgh. The Scottish connection, where is Sean Connery when you need him?

Who are David Jones? One of Australia's oldest businesses. David Jones himself was a Welsh immigrant who wanted to sell (as per the David Jones website): "the best and most exclusive goods". The first store was opened in 1838 (it turned 175 years old last year), which is a while back, but currently there are "only" 35 stores, two warehouses and an online presence. David Jones has over 1000 brands. Astonishing. Food and wine, kids clothes, as well as electrical items, homeware products, beauty products, shoes aplenty of course. Lots and lots of products and brands for 1.042 billion Aussie Dollars of sales for a half. Wow. Sounds very hard. But this business has 265 thousand Facebook followers, so their brands obviously attract a lot of attention. So with all that history, this is a brand well entrenched in Australian retail.

OK, so is this a good deal for you, a Woolworths shareholder? At 24 times forward earnings it seems like a very rich price. But. The retail environment in Australia has been under pressure, sales have been going sideways. That should be a good thing, right? In 2008, the company had sales of just over 2 billion Aussie Dollars. So not much action there for five years, about the same applies now from a sales point of view. Going sideways. By another metric, Woolworths are buying the business for 1.16 times annual sales (2013 - 1.8 billion Aussie Dollars revenue). Woolies trades at 1.75 annual sales. It seems expensive, the purchase, and in that very Bloomberg interview, the DJ's (Paul says it is known colloquially in Aussie as that) Chairman says it is a great deal for them. Cairns spoke about increased competition from Zara, Top Shop and H&M and the deal was necessary for building scale and creating a South Hemisphere retailer to compete with their Northern counterparts.

There is an opinion piece, titled David Jones takeover: The foreign brands are here because Australia is rubbish at retail in the Sydney Morning Herald (SMH - not, shake my head) written by Michael Pascoe, who describes himself on his website as "one of Australia's most experienced and thoughtful finance and economics commentators with four decades in newspaper, broadcast and on-line journalism, covering the full gamut of economic and business issues". He describes the current crop of management as inexperienced and a little old style.

Paul Zahra is taking over a company that had drastically underinvested in its future, concentrating on immediate profits using a dying formula while persevering with a steam-powered point of sale system.