Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Talking about Nike being a Dow constituent earlier, the company reported results on Thursday evening after the market had closed. Initially the market reacted positively to the number, that were an earnings beat, but the guidance about the stronger Dollar impacting on sales through to 2015 put a lid on that enthusiasm. This was for the third quarter to end February, that is why the results feel out of whack with the rest of the market, Nike's year end is May. Perhaps there is a lot to be said for breathing that fresh Oregon air. A relatively small state population wise, ranked 39 out of the US states from a density point of view suggests that there are wide open spaces to test the best athletic gear in the world. Nike headquarters are not even in Beaverton, which itself is around 10km from the state capital of Portland. I guess with fresh air and blue skies, the Nike engineers can do their stuff. In late September I wrote a detailed piece about the company, for a refresher -> Nike runs hard!

Nike owns Converse (since 2003) and Hurley (since 2002), but they are smaller contributors to the company's overall sales, no doubt they will grow in years to come. I guess the association with hip lifestyle slash skateboarder means that the market is smallish. Hurley sponsor a whole host of athletes that I have never heard of! I suppose I should pay more attention, but I have never surfed and my skateboarding leaves a lot to be desired. The strength of the parent company Nike however is their footwear, I have used Nike to run for nearly 15 years. I have never had a problem with injuries, but perhaps that is because I run too slowly!!

North America is still Nike's most profitable region, about as profitable as their Western Europe, Greater Japan and Emerging markets regions put together. Japan is a tough market, the company generates only around 20 million Dollars a quarter in EBIT from that country. Japanese Dollar revenues were hit hard by the strengthening Dollar, down 9 percent, with apparel sales falling 16 percent in Dollar terms. Overall on a 9 month basis revenues in Dollar terms increased over 9 percent to 19.092 billion Dollars, EBIT increased by 13 percent to 2.665 billion Dollars. The company as you can see, is very profitable. People in emerging markets are still buying sports apparel at a breakneck speed, excluding currency changes apparel sales grew 31 percent in the quarter. Nike would want Manchester United to improve their season and get a Champions League berth, I am pretty sure that it really matters to their sales. I suppose the weekend results (even though they themselves won) did not go in their direction.

The World Cup is 79 days away and some hours from kick off, that should get you through winter!! Nike sponsors the hosts and France, as well as England and the Netherlands. Adidas host the rest of the real contenders, Argentina, Germany and Spain, whilst Puma sponsors Italy, Uruguay, Cameroon, Ghana and the Ivory Coast. So if you are a Nike shareholder, you would want all those countries to do really well. England have a tough group, group D, where they find themselves with Uruguay and Italy as well as Costa Rica. Poor Costa Rica. Who are sponsored by Lotto, the Italian sportswear manufacturer. Interestingly Manchester United and Barcelona (ha-ha, what a victory last evening against their arch rivals!!!) sell more shirts than any other football club and both are sponsored by Nike.

Perhaps that is a good note to end off on, the fact that the market is dominated by Adidas and Nike, collective they have 26 percent of the global sporting goods market. Which might sound a little light to many people, Nike has around 14.6 percent and Adidas 11.4 percent. So there is ironically a lot more room for dominance by both these apparel and footwear (and equipment) manufacturers. Nike have only been in football for 20 years, pushing a lot later in a cycle where Adidas have had double the time in football. Nike dominate in North America with all their premium products at uniquely American sports, baseball, gridiron football, basketball and ice hockey are pretty niche sports, but there are of course many different codes of sports (and equipment) that Nike do not participate in. Gym equipment, big ticket items such as treadmills, stationary bikes, even bikes themselves would all attract a premium if they were Nike manufactured, I have no doubt.

But sticking to their knitting and being a high margin and quality business is possibly much better for shareholders, which of course include a significant holding by Phil Knight, the founder. If he converted his shares away from the ones with voting rights (he has around 75.6 percent of the A shares) to B's, he would own roughly 15.8 percent of the company. Yowsers. He does from time to time sell and donate money to charitable causes, and whilst this may be a problem, the company does also embark on pretty aggressive share buybacks.

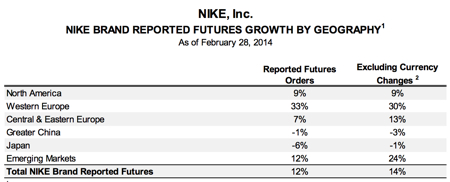

So where to from here? In their annual report 2013 .pdf the company says that they are a growth company. The current results report has a segment titled future growth by geography, and the 2014 predictions, are muted, in terms of shorter term growth prospect. "Futures orders by geography and in total for NIKE Brand athletic footwear and apparel scheduled for delivery from March 2014 through July 2014, excluding NIKE Golf and Hurley." Here it is, the table:

So, a growth company with low double digit growth, on a 25 earnings multiple. That I think is the part that spooked the market Friday, sending the stock down 5 percent. So whilst the earnings actual (76 cents per share for the third quarter) beat expectations, many lowered their earnings for the full year. So this is how currency movements (violent ones at that) can have a marked impact on the sales of a global business, like Nike. Notwithstanding that, we really do like the aspirational consumer element to this company, they make quality products that both rich and middle income people want and do buy. We continue to add to the stock on weakness.