Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

This morning we received interim results from AVI for the 6 months ended 31 December. I must say I really like this business but it has struggled of late share price wise thanks to a weaker Rand and along with that a weaker consumer. The share price is back to where it was in July of 2012 after absolutely flying since 2009. Before we delve into the numbers lets just remind ourselves of their brands portfolio.

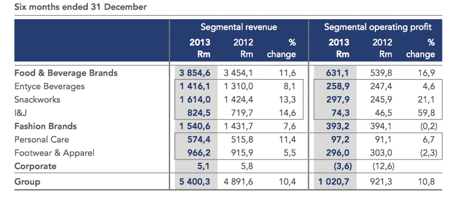

Click on this link AVI Brands which will lead you to the website. There is a nice feature which allows you to flick through the brand portfolio. They have divided these brands into 2 divisions, Food & Beverages Brands and Fashion Brands. Within these divisions under Food and Beverages we have Entyce, Snackworks and I&J and under the fashion umbrella they have Personal care and Footwear & Apparel. I hacked a table from their results presentation that highlights this divisional breakdown and shows you where the profits are coming from.

Wow look at the apparel margins. AVI bought this business in 2005 and it has been a great acquisition as a growing South African middle class has been drawn to luxury goods like a moth to a lamp. It makes sense, when you have people who have previously lacked the liberalisation that money affords, no matter where you are in the world, once that freedom is granted by a growth in earnings, the temptations to flaunt ones newly earned wealth has created a huge boom in luxury spend. Great timing from management.

But as you can see here, the luxury brands, which compromise nearly 40% of profits have finally hit a speed bump. A weaker rand has created more expensive imports which have to be pushed onto a weaker consumer (who are ironically weaker because of this exact reason). It is a double edged sword. However they do have a natural hedge here, the I&J business has benefited from the weaker Rand.

The Snackworks business has grown nicely. Biscuits always seem to be good value for money. They are very cheap to manufacture but go a long way as far as the consumer is concerned. All these moving parts resulted in sales growing 10% while headline earnings per share also increased 10% to 231c. The first half is usually a lot better than the second because it includes the festive season. Lets assume they make 380c for the full year which puts them on forward times 2014 earnings of 13.4. That seems cheap, but it's cheap for a reason, not much is expected from their target SA consumer this year.

Food, coffee, tea, cosmetics and luxury brands. All sectors that I like over the long term. I think this tough patch in the cycle is a good buying opportunity for a business like AVI.