Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

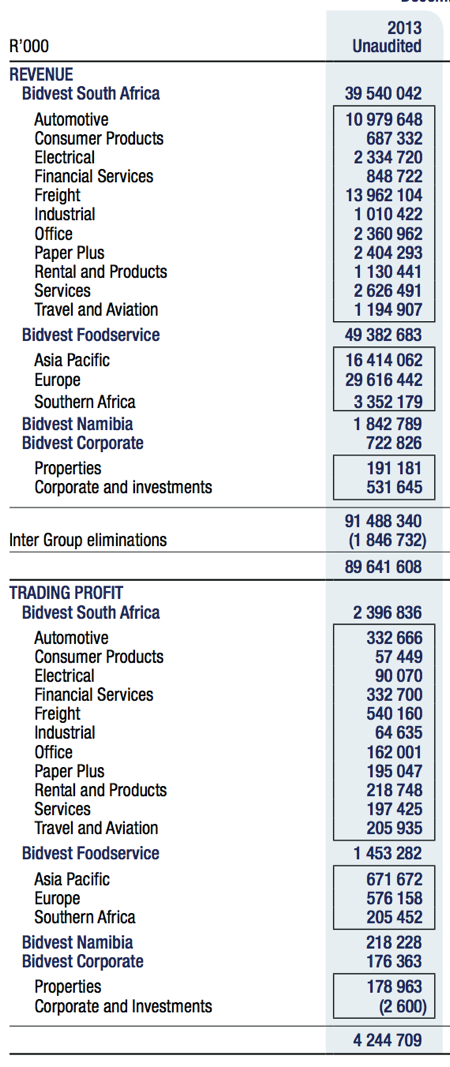

Bidvest have reported results for the half year to end December 2013 this morning. Revenue increased nearly 19 percent to 89.6 billion rand, EBITDA increased by slightly more than 19 percent to 5.4 billion Rand, headline earnings increased by 16.7 percent to 842.3 cents per share, whilst distributions per share was up 22.9 percent to 398.1 cents. The stock has reacted positively to the numbers, up about a percent more than the rest of the market as a whole.

There are four very big divisions by way of revenue inside of Bidvest are their local automotive business, those are the dealerships, Burchmore's and McCarthy which turned over 10.979 billion Rand last year (a 4.8 percent increase), but managed to see profits rise by 8.3 percent to 332 million Rand. That is the second biggest South African division, the biggest is their freight division which contributed 17 percent more than last year and managed to grow profits by nearly 20 percent to 540 million Rand. In the the South African complex the Financial Services business is very profitable, but by way of revenues their two international foodservice's businesses are the two biggest by revenue and profits, Foodservice Asia Pacific and Foodservice Europe (nearly twice the size of Foodservice Asia Pacific). See the graphic below:

So whilst the Asia Pacific business is not so much China as it is Australia and New Zealand, the company is working hard at changing that, they are achieving rapidly growing sales in mainland China with established businesses in Hong Kong and also Singapore. I am not too sure where a smaller Chilean business sits here, seemingly in the Asia Pacific business mix, but Bidvest has indicated that Brazil is their next target market in South America. Interesting, there must be plenty of opportunities against what is a very negative backdrop.

The European Foodservices business which consists of a large 3663 branded business in the UK and Deli XL in the Netherlands and Belgium is well supported by some of the older Eastern European businesses in Slovakia and the Czech Republic, as well as Poland and the Baltics. Their Middle Eastern business was OK, problems in the region of course still remain. So those are the two of the big four, the other two are South African Freight and their Automotive business, as per above.

There are many separate divisions here, and then there is essentially a new one with the acquisition of a 34.5 percent stake in Adcock, in truth it adds another layer to a whole bunch of holdings that the company already has. But remember that Bidvest are a much more sizeable business than ever before and can use the bigger existing cash flows from their established businesses to fund newer acquisitions, like the Adcock one. Quite how they are going to implement the Brian Joffe magic remains to be seen, the original deal making history is to normally acquire quality businesses at good prices and then leave the existing management to run the business. Not too dissimilar to Warren Buffett from Berkshire Hathaway, Mr. Joffe has been compared to the Oracle of Omaha. Bidvest of course emphasises decentralised management.

The two major acquisitions finalised in this half year, outside of Adcock Ingram were HoLB and Mvelaserve, 1.9 billion Rand worth of investments in the half. Never, ever standing still at the relatively small head office. So what should you expect from Bidvest for the second half of the year? I guess muted really, South Africa remains in a funk, higher inflation equals higher rates and lower growth rates are expected. But business in Europe is improving and should start to be more helpful from an earnings point of view. Asia Pacific offers many opportunities still and you could argue that this is the future of the business, in terms of scaling up in a region with lots of opportunities. The richer that the region becomes, the more services that everyone requires.

So where to here? Well, the business is good, very well run (Brian Joffe cannot run the business forever however) and continues to generate excess capital that needs to find a home. And by that I mean that the business will continue to make bite size acquisitions in sectors that they have existing businesses and where they think they can influence the business. There is an opportunity here to unlock value by listing the separate parts either in Hong Kong, or in London. But perhaps it will just be business as usual, a reliable services company that will deliver you above inflationary returns in the long and short run. We continue to accumulate.