Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received interim results from Discovery for the 6 months ending December 2013. Here are the financial highlights.

"The period saw normalised profit from operations up 21% to R2 383 million; normalised headline earnings up 22% to R1 650 million; growth in new business annualised premium income up 19% to R5 883 million; excellent performance in the key drivers of new business, loss ratios and lapses across all of Discovery's businesses; growth in embedded value of 19%; and cash generated from operations over the period of R1.3 billion."

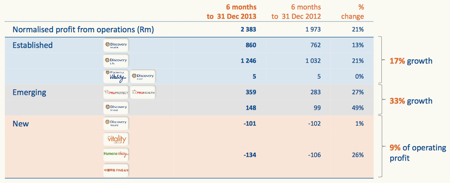

The company is still growing at a strong rate off what is becoming a very high base. But as you will see below, the opportunities and potential are huge. Before we look at the business per division, here is a graphic which lays out the different businesses by profits.

Health. As you can see from the table, Health is the second biggest contributor to profits (R860mn). New business increased 15%. As a member myself I can see why new business is growing so strongly in a fairly mature market, the product is great. What else was impressive was that loss ratios continue to decline as the Vitality product succeeds in making customers healthier. Because believe it or not, it is a general rule for insurers to pay out more than the premiums they receive.

Life. Life is the biggest part of the business (R1246mn) which grew earnings 21%. There are huge synergies here between the Health division and Vitality. Firstly Vitality users who are healthier live for longer and therefore pay premiums for longer. Secondly it makes perfect sense that if you have Discovery Health, you will do your Life insurance through Discovery and visa versa. Of course the company makes that decision a lot easier with all sorts of incentives. It is also nice to have all these products under one umbrella.

Invest. Again people who are not in the know (otherwise they would all come to Vestact) and want to keep all their products under one umbrella will just use Discovery Invest to manage their money. Assets under management grew by 35% to R36bn. It is still small and has plenty room to grow.

Insure. Sasha recently insured his car with Discovery. He loves it because he drives like a granny and gets plenty benefits. Remember they install a tracker and monitor your driving. It is a very innovative product. New business grew 40% to R257mn.

The UK. Business is starting to take off in this region. Profits grew by 27% (now the third biggest contributor) and new business grew 35%. The national health system in the UK has a bad reputation and people who can afford it are insuring their health and going private. We already know that the Discovery product is quality, especially with the addition of Vitality. Those Brits need to exercise!

Ping An.The Chinese market has huge potential. 37% of healthcare spend comes from out of pocket. Discovery own 25% of Ping An health which is a subsidiary of the biggest insurer in China, Ping An Insure. The business is still small but new business doubled for the period so expect this to become more influential in the future. 3-5 years according to Adrian Gore.

Vitality. Now this the exciting part. Both in the US and in Asia, Discovery are leasing out their Vitality intellectual property, mostly to corporates for their employee wellness solutions. A healthy body is a healthy mind which means more productivity from employees. I am a strong believer of that, plus it is win win because the employee gets healthier at the same time. This is taking place in Singapore, Australia and the US. I suspect that we will be seeing plenty more of this adoption going forward.

Valuations. Embedded value sits at R39.8bn. The current market cap sits at R45.8bn, a 15% premium. And rightfully so. The growth rates and potential are huge. Earnings came in at 307c. Very simply, if you annualise that we get R6. Trading at R77.50 the stock seems cheap at 13 times earnings. I remain conviction buy.