Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

This morning we received results for the year ending 31 December 2013 from South Africa's biggest private school operator, Curro. Wow this business is flying. Learners increased by 69%, Revenue increased 80% and HEPS increased 87%. Of course there is a reason for this growth. Last year the company spent R1bn on acquisitions, development and expansion. That is big when you consider that the company's market cap sits at around R8bn. But throughout last year that number was closer to R5bn. Yes the share price has done that well.

The funding for this R1bn came from that rights issue they did last year (R600mn), that R397mn funding programme arranged by Old Mutual and the PIC (I wrote about this a while back: Curro announces big school push) and various debt programmes.

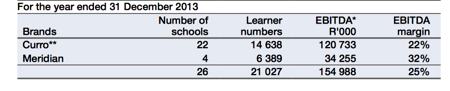

The company compromises of 31 schools with 26 463 learners as we speak. For the year of 2013 for which the numbers are attributed to, the company had 26 schools. Within these schools there are 2 brands namely Curro and Meridian. The Curro brand is more focused on higher LSM groups with an average class size of 20-25 learners and monthly fees of R3700. Meridian has larger classes of 30-50 and lower fees of R1400 per month. This gives poorer people the opportunity to give their children a private school education. Below I have added a table of the brand structure within Curro.

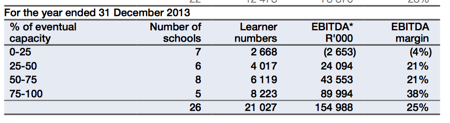

Another interesting table they put in their presentation looks at the % capacity of their current schools and the kind of margins they make.

Clearly it is imperative to fill up these schools as soon as possible to get that EBITA margin as high as possible. That is where the demand for their services come in. If you have read my writing on this stock before you will know that I am a firm believer that there will be huge demand for this product because there is such a big gap in the market left by an inefficient government.

But the company is not stopping there. They are going to carry on acquiring and developing. As I suspected last year they have announced yet another rights issue. They are planning to raise R589mn by issuing 1 right to every 10 shares held at R20. A fat discount to today's R28.

Diluted Headline earnings per share came in at 13c. Trading at R28 the stock trades at 215 times earnings. But this is the first year of profits, I wouldn't worry about valuations at this stage, especially when they are raising money on a yearly basis, seemingly. I still like the company and I like the sector. I would advise all shareholders to follow their rights.