Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

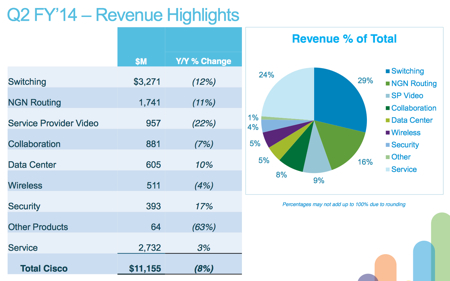

Last night we received quarterly results from Cisco which again looked fairly muted but above analyst expectations. Revenues were down 7.8% to $11.8bn. Net income for the period was down 54.5% but that was because there were a few once off charges. From continuing operations Non-GAAP net income came in at $2.5bn which was down 7.4% from this quarter last year. This equated to 47c per share. The image below pretty much summarises where and how this business makes money.

Yet again the market was disappointed and the share price declined 4% after the market closed. John Chambers just seems to drone on and on about the same thing.

"We delivered the results we expected this quarter. I'm pleased with the progress we've made managing through the technology transitions of cloud, mobile, security and video. Our financials are strong and our strategy is solid. The major market transitions are networking centric and as the Internet of Everything becomes more important to business, cities and countries, Cisco is uniquely positioned to help our customers solve their biggest business problems."

Wow, the man is bullet proof and said something very similar during the last presentation. We are patient investors but this has been his tone for the last 3 years. I still really like the thesis behind this stock as an investment. They provide the routers and the servers that connect big businesses to the internet. They also service this hardware. It is a great margin business but it is becoming very competitive and these margins are getting squeezed. Especially in developing markets.

The company needs new management and fresh ideas in my opinion and the fact that Chambers is both chairman and CEO does not sit well with me.

Having said all this, the stock is cheap. Earnings expectations are for $1.86. Trading at 21.90 we are sitting on forward earnings of 11.8 times. Plus they are sitting on $47bn of cash which is nearly 40% of their market cap. The fundamentals are strong and I'd expect demand for their product will grow, especially as people expect faster and more efficient internet services. I would hold this one but I wouldn't be adding until we see some shifts in management.