Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Wednesday we received a trading update for the first quarter ending 31 December from African bank. They start the update elaborating on the tough conditions in the economy.

"The South African economy continues to prove increasingly challenging for consumers and consumer led demand businesses. The consolidated impact of the fuel price hikes, interest rate increases and food inflation against the backdrop of a weakened rand has and will continue to present challenges that the group needs to address."

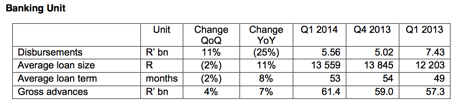

Yes, unfortunately at a time when Abil were aggressively growing their loan book the economy started to turn out of favour for the business who almost exclusively target lower end consumers. Below is the table they put out with movements within the banking unit.

As you can see they are still suffering the consequences of their aggressive growth spurt but the commentary is still very much focused on ironing that out and focusing on the future.

The quality of new business written has improved, based on early performance indicators and vintage curves and our new pricing initiatives are positively impacting the incoming yield. Income yield after suspension of interest on affected non-performing loans (NPLs) continues to stabilise at FY2013 levels. While collections remain challenging, particularly over the December and January periods, the stabilizing trend over the last few months remains intact.

I'd expect to see weak numbers throughout the year and maybe some sort of stabilization next year as that ironing out takes affect.

The retail unit is still struggling. Merchandise sales were down 21% year on year while credit sales declined 32%. They are desperately trying to sell the Ellerines business while keeping the credit book. Shoprite and Steinhoff are names which come to mind but the asset will have to be given away at a big discount to be worth anyones while. The unit has been poorly run.

I still feel that micro lending has a very important role to play in a developing market economy. It's a very complex topic and the business model is a really good one when it comes to making money. In fact Finbond, a tiny micro lender was the best preforming share on the JSE last year. Ironic when you consider how badly African Bank have done. Investors certainly have a love hate relationship with the sector and a lot depends on where you find yourself in the sector. For me there is still too much uncertainty in the sector and specifically the company.