Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Tiger Brands released their results yesterday, with the Key financial indicators according to the SENS are:

Key financial indicators

INCLUDING DFM

Group turnover R27,0 bn Up 19,1%

Operating profit# R3,1 bn Down 11,6%

Headline earnings per share 1 624 cents Down 3,8%

EXCLUDING DFM

Group turnover R24,7 bn Up 8,8%

Operating profit# R3,5 bn Flat on previous year

Headline earnings per share 1 781 cents Up 5,4%

#Before abnormal items

DFM stands for Dangote Flour Mills, which is a Nigerian company they purchased towards the end of last year. DFM accounts for 9.3% of Tiger Brands' revenue, and due to its poor performance has distorted the performance of the rest of the Tiger Brands' business, so as an investor relations officer, you want to put the company in the best possible light, hence the "excluding DFM" section.

I am not too worried about the DFM performance because Tiger Brands is in the process of streamlining the company by selling assets they don't need, removing duplications, and up-skilling staff. The SENS announcement says it best:"we expect that it will take two to three years to fully align the DFM operations to Tiger Brands standards and for the business to deliver acceptable returns. However, the group remains optimistic that this investment in one of the fastest growing economies in Sub-Saharan Africa, will meet expectations over the medium term" Once DFM is at Tiger Brands' standards, it will be in a good position to take advantage of the growth in Nigeria. Interesting side fact, Nigeria's GDP could be larger than South Africa's soon due to a change in the way that their GDP is calculated.

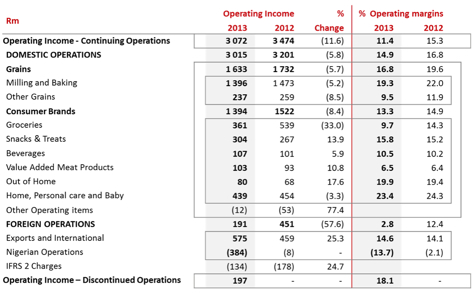

Below is a breakdown of the different divisions, and how they are faring from the previous year.

The stand out items are that Groceries EBIT is down 33%; sales for groceries was only down 1.7%, but margins decreased from 14.3% to 9.7%. The drop in margins is due to increased input costs that they didn't want to push through to the consumer, preferring instead to keep their market share. When the consumer (you and I) have more money to spend, we will see these margins increasing again.

The next standout item is the "Out of Home" division, which is the division that supplies their products to caterers. Sales were up 14.9% to R403 million; so the increase was off a small base.

Foreign operations excluding Nigeria had sales up by 21.7% to just short of R4 Billion, where 12.1% of the gain was attributed to the weaker Rand. The African map shows their operations, where you can add Chile to the list of manufacturing countries and then USA, Canada, Australia, New Zealand, Malaysia, Taiwan, Saudi Arabia, Portugal, Germany, UK and Sweden to the list of countries that they distribute to.

When evaluating a company, I always like to refresh myself on the brands that they own, and for me when I think I Tiger Brands, I always think of Jungle Oats, and Albany bread. Have a look at their brands page http://www.tigerbrands.co.za/brands.php, I'm sure that you will find at least one brand that you didn't know they owned, for me it was Peaceful Sleep and Spray ‘n Cook.

Their brands are well known and many being the brand leader in their respective industry, and the company has established African exposure where significant growth should be seen in the future. So Tiger Brands, ticks all the boxes for us; quality company (strong brands), in an essential sector (everyone needs to eat) and it has good growth potential.