Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Aspen. The company that keeps on giving, at least for the stock holders and at least on paper. We will deal with the valuation of the company in the second part of this, the first part will deal with the company itself and their full year numbers that hit the screens at 30 minutes past midday exactly. Just as we were tackling our chicken salads, that is what we all ate for lunch! Paul pushed his computer screen back the other day and commented that perhaps that was the right length away in terms of viewing his computer. Pity that the keyboard is not detachable!

So first we will look at Aspen's numbers. Revenue up 27 percent to 19.3 billion ZAR, operating income increased 28 percent to 5.043 billion, headline earnings (from continuing operations) up 26.6 percent to 3.588 billion ZAR, some of the metrics are AHEAD of the five year average growth rates. Average revenue growth for the last five years has topped 23 percent, profits 28.5 percent whilst HEPS has increased on average 20.3 percent for the last five years. Cash generation increased a whopping 37 percent.

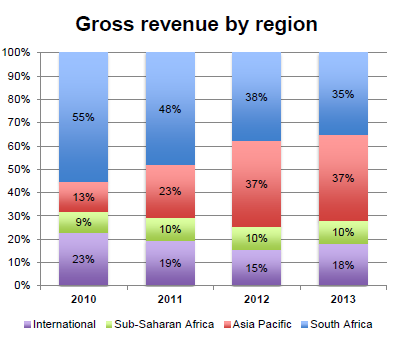

In 2008 the South African revenue contribution to Aspen's business was 58 percent. In 2010 that was 55 percent. Yesterday that number was 38 percent. Check out how the business has quickly moved towards being an Asia Pacific one and no longer a South African one:

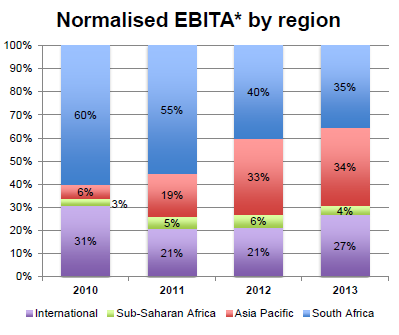

And then from a profits point of view, here goes:

Now through all of this breakneck speed growth in both revenue and earnings, the important factor, margins, have been maintained at 27 percent. That amazes me. All of these slides and a whole lot more are available on the Aspen Investor Relations website, you can download the booklet here: Group Financial Results.

Of course borrowings will rise from their current levels, because of the pending transactions, which include an API Manufacturing unit from MSD in the Netherlands, and an option to acquire a portfolio of 11 "branded finished dose form molecules", as well as the anticoagulant therapies purchased from GSK as well as two separate transactions with Nestle to acquire their infant nutrition business across different geographies. Five different pending transactions, worth 36 million Euros, 600 million Dollars, 700 million Pounds and whilst there is less clarity on the value of the Nestle transactions, these are all REALLY sizeable.

The opening sentence of the prospects column is in itself interesting and worth republishing: "The completion of the impending MSD and GSK transactions will transform the Group, expanding the global brands portfolio with the addition of established products which have strong market acceptance and widening Aspen's geographic reach." Aspen is now looking at establishing their own businesses in Russia and the former Soviet Republics, and also Europe. As well as expanding their reach in fast growing businesses in Latin America and Asia, both geographies have been growing. The opportunities are there and exist, it is a matter of execution. So there is the business, a really good one with loads of potential!

The multiple that the market has afforded to the company has grown from 16 times to nearly 29 times, expanding on average by 20 percent per annum. That has meant that the market cap of Aspen has grown from 20 billion Rand in 2009 to just below 116 billion Rand as of the close of trade yesterday evening. That is adding nearly 100 billion Rand worth of value to investors over half a decade. That is nothing short of eye popping, from a second tier company in this market, to a global company in emerging markets. And much of that has come in the last five years.

Rather than worrying about what you should pay for Aspen today, worry about what the business could possibly look like in two, five, ten years time. That is very, very hard, because almost anything could happen. I shall try and answer by showing you that relative to some sizeable businesses in the sector (some of which are not really growing that fast) that Aspen is not "out there" from a valuations point of view. Taken from Google finance, which is free. Ha-ha.

I think that what I am trying to demonstrate and show is that investors pay up for businesses that are quality, well run and growing in a sector that has growth potential. Healthcare! The older people get, the more they want and need expensive therapies. This industry is evolving really quickly. We continue to maintain our overweight position in what is a brilliant company, run by a man who does NOT get enough airtime and is not put forward as a model of success in South Africa. He has so much to teach us. I guess as a fellow who owns (indirectly and directly) over 55 million shares at a value of 14.161 billion Rand, Stephen Saad has more to lose and gain than your average CEO of a listed business. What a legend. We need more of these entrepreneurial types around here!!