Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

LOreal released their half year results this morning. This business carries some of the best known beauty products globally, Lancome, Cacharel, Vichy, Maybelline, Redken, Kerastase and of course LOreal itself. Please forgive me for having left off all of the accents there, the "interwebs" does not take kindly to some of the formatting. Through history humans have used cosmetic products to enhance their beauty. I keep telling my wife she needs none, but I get it! Even after a decade plus of marriage, I get that I have to be patient when going somewhere, you cant just leave in a hurry. Everything from foundations through eyeliners to nail polish, beauty is a serious business. For the consumers and the producers.

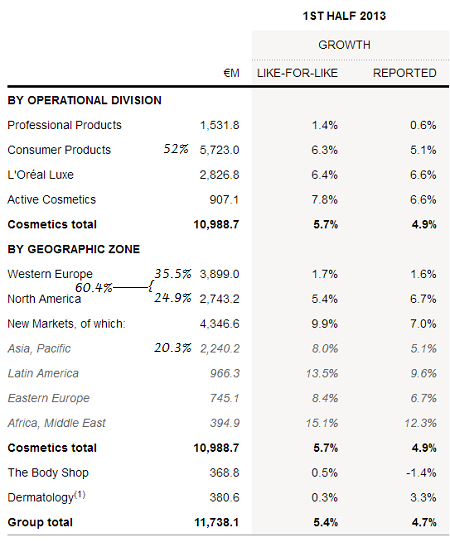

I think that in order to understand this business historically is to also understand that their biggest businesses are their historic ones. Europe and North America still contribute 60 percent to their overall revenues. But the fastest growing regions are Latin America and here, our region, Africa and the Middle East. Sadly for shareholders however, these two geographies contribute only 12.4 percent, but as you can see, they are growing fast. The consumer product division is their leading revenue contributor, interestingly the margins are pretty good across all their divisions. Quickly the breakdown of what we are talking about:

So now you have a pretty good idea of where the business makes their money. But as investors it is sometimes not always about understanding the business, and in particular a business like this, than it is about understanding consumer habits. LOreal itself is one of the oldest brands in the world, with Liliane Bettencourts father, Eugene Schueller having founded the company in 1909, in his late twenties. Schueller founded the company with the intention of focusing on hair products specifically. But of course businesses evolve.

Schueller and Bettencourt are both controversial characters. Schueller was a fascist who supported the Nazis in Vichy France. Ironically, his only granddaughter, Francoise Meyerss husband is a fellow by the name of Jean-Pierre Meyers. Meyers grandparents died in Nazi concentration camps during the Second World War. But Bettencourt has also been shrouded with controversy and her daughter and son in law are dealing with trying to change her will. She is 90, and one of the richest people in the world, with a 30.5 percent holding in LOreal. Of that 30.5 percent, 12.5 percent more or less is in a trust, with Liliane Bettencourts daughter Francoise Bettencourt Meyers is the beneficiary.

How did Nestle end up being the same sized shareholder as Bettencourt? Well, as far as I can tell from a Wikipedia article, Bettencourt swapped half of her stake in 1974 for a 3 percent stake in Nestle, which of course is in Switzerland, through a 49% Nestle and 51% Bettencourt holding in a company called Gesparal. That all unwound in 2004.

But why did Bettencourt do that in the first place? Well, the socialists came to power in France and she was worried that the government would nationalise the company. I suspect that investment has probably done fabulously well too, provided she still has it. Why did I mention all of this, well, the shareholding is important here, together Nestle and Bettencourt control one of the worlds biggest cosmetics companies.

The stock is up over four and a half percent in Paris, trading at 128 Euros. Half year earnings per share clocked 2.94 Euros a share and grew at 7.1 percent relative to the prior reporting period. So the stock trades at a 20 plus multiple, which is not cheap, but for these growth rates I would think that is not all bad. The critical part however of today, is that LOreal intimated that they could buy back the Nestle stake. LOreal holds a 9 percent stake in Sanofi, worth about as many in billions of Euros, there is some change right there. What is probably more likely however, is that Nestle could swoop here. Why not? Either way, as a shareholder, somebody will have to pay up here. Unless the current shareholding structure continues to exist.

Either way, this is a quality business. Their core markets are resilient and their emerging markets are growing strongly. Cosmetics are a great business to be invested in, whilst the R&D and advertising bills are huge, the margins are still amazing. This is a definite way to continue to invest in growing consumer spend across the globe. Buy.