Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

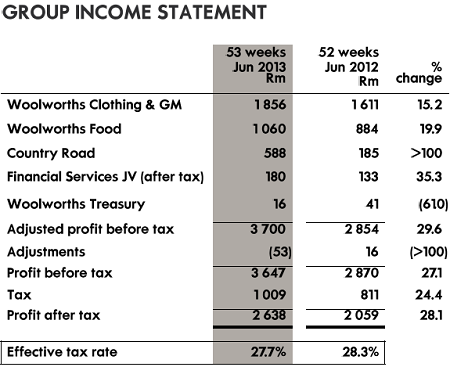

Woolworths have released results for the full year to end June this morning. These are for the 53 weeks to end the 30th of June 2013. We wrote about the trading update when it was released around 40 days ago. That seems like quite a while back. Expectations for HEPS back then were expected to be 25 to 30 percent better, it was almost exactly in the middle of the range, the reported number is 27.3 higher than the prior year at 340.4 cents per share. Dividends, oh don't we know how important those are, for the second half of the year those have clocked 148 cents, or 125.8 cents after the 15 percent dividend tax. For the full year, including the 86 cents, or 73.1 cents post tax at the half year stage, the total dividend is 234 cents pre tax, or 198.9 cents post tax. The company has a very generous dividend cover of 1.45 times!

The price of the stock is currently just below 60 ZAR a share (closed at 5984), and therefore as of this morning trades on a historical earnings multiple of 17.6 times earnings and a dividend yield post tax of 3.32 percent. Is that expensive for a company that has grown their earnings by 25 percent per annum for the last six years now? You could have bought the stock at below 10 Rand a share in the wash out towards the end of 2008, and seen that expand to just above 80 Rand a share in the middle of May this year.

But all that only tells a small part of the story, the smallest part normally. When you buy a listed security, you own a part of that business. When the company reflects this to the public and their stockholders, you will see it forms part of the shareholders equity, which is simply total assets minus total liabilities. Or, share capital plus retained earnings minus treasury shares. Committing capital to businesses to return you above inflationary (and above market returns) seems like such a simple exercise. But it is not. We are getting off the topic here, Woolies sells food, clothing, beauty and homeware under their brands. The company prides itself on quality and that is where the differentiation is, quality.

To emphasise this part, Woolworths food division has been growing ahead of the market (as per their presentation -> Woolies annual results 2013) every month for the last two years. On top of that market share grab gross profits margins continue to rise too. The clothing and footwear segment over the last twelve months has seen Woolies hold onto their 15.4 percent market share.

So what do Woolworths see themselves as in a few years time? The company wants to be one of the leading fashion retailers in the southern hemisphere, but also become a much bigger foods business. The foods growth with come from increasing their bulk offerings (I always buy the bulks, I am lucky enough to have a big pantry). The company will continue to open bigger sized stores, if you have visited the Nicholway shopping centre you would have found the awesome new Woolworths there. Well, not so new anymore, but that is at least the format being put forward. They are planning to grow by around 50 new food stores and around 70 odd new clothing stores over the next three years.

Some of the Woolies clothing is expensive, but the quality backs the newer (and older established) brands. New brands at least to South Africans. Expect more Country Road and Trenery stores here locally, as well as the introduction of Witchery and Mimco. Mimco was the only brand that I was not too familiar with, but a quick web search revealed that Mimco are a top end seller of bags, jewellery, wallets, shoes and accessories. Not the kind of stuff that men pay too much attention to, but collectively as investors (men and women) these are equally important!! I can tell you that the Mimco branding looks like an upside down W for Woolies, it fits already.

Why push the clothing? This slide explains much of that, to me at least. Profits from their Country Road division are around 60 percent of their entire foods division. Check:

But much of this will depend on the consumer. And of course not all consumers are the same. The company make the point that the core clientele (of which they track around 2 out of every 3 shopping activities through the rewards programs) does not really spend as much on credit (internal) as the rest of the industry. Plus, the top end consumer is more insulated. That is natural. As such, you could argue that the retail cycle does not hit them as hard, at least currently.

The stock is not expensive relative to their earnings growth record, and even though there is a more muted outlook presently, we rate the company a buy at present levels. It is well managed, the ship has been turned in the right direction, the fashion mix is finally right and recent acquisitions have paid off. More in the coming days as the extra news flow comes through!