Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received a trading statement for the half year from Massmart which has disappointed the market. The share price is down 8% since the release. Let's take a look at the numbers.

There were lots of moving parts last year which included the big transaction cost from the Wal-Mart deal. There was also a big foreign exchange loss in Malawi. This is how they explain it in the results release from last year.

"Although the Rand weakened against the Dollar during the financial year, the Group incurred a foreign exchange translation loss on its African businesses of R72.5 million due to the unrealised translation loss caused by the significant currency devaluation in Malawi in May 2012."

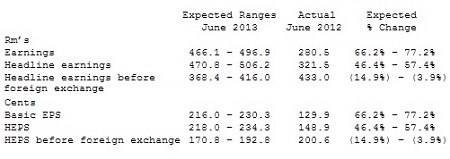

So that explains the ''HEPS before foreign exchange'' which I think is fine to ignore. But more importantly it explains why the Headline number is up so much and this is the number we need to look at, 218c to 234,3c. This is why the market is so disappointed. Analyst expectations for the full year are for R6.96. Even the top of the range R2.34 is very far off this number.

Should we be concerned? There is room, the stock is extremely expensive. Being very generous assuming they make R5 for the full year, that puts the stock on a multiple of 30 times at its current share price of R150. But we always knew it was expensive and even though the stock has had a tough period it has still outperformed Shoprite this year.

We are in this one for the long term and I truly believe we will see a massive ramp up in earnings over the next few years once all the moving parts have settled down.

On that note the company is currently exploring the purchase of a big retailer in Kenya. This Business Day article covers the details quite nicely Massmart's forecast earnings rise disappoints. The title is not the best but the article is better.

As you can see Naivus, the company Massmart want to buy a 67% stake in, has 28 stores and is Kenya s fourth biggest retailer. There is currently a family feud stalling negotiations but once that is sorted it seems like a good entry into East Africa's largest economy.

To conclude. If you own Massmart shares I would certainly hold and be patient. I drove past the new Makro in Nelspruit two weeks ago and there were queues just to get parking. The demand is there, it just depends how fast Massmart can expand both in South Africa and the Continent. You would have to expect that the Wal-Mart influence has the expertise to do this fast and efficiently.