Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Thanks again for your feedback, we really appreciate it. This is a piece on Anglo, following our piece from yesterday, in case you missed it: Anglo American results, how good were they? Packed with useful insights about the company, and specifically what it has meant for you, if you are a shareholder. We shall call the long time reader, and even longer time investor in equity markets, nearly spanning 5 decades, Wilson. Why Wilson? Because Wilson is my most favourite character in a TV show, remember the next door neighbour in Home Improvement? The guy with the hat who would always talk to Tim the Toolman Taylor about his problems, that was Wilson. You would never see his face, but he always had the solution. Here is Wilson's response:

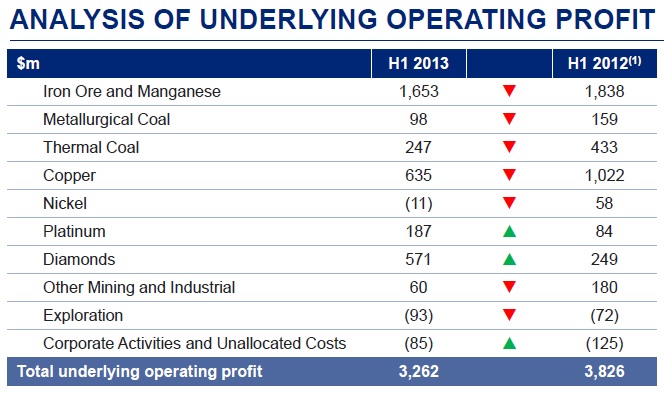

First and foremost, (and a little later in the presentation) the most profitable region for the company is South Africa, which constitutes 2.159 billion Dollars of the 3.262 billion Dollars of group "underlying profits". That is two thirds of profits. And the rumour mill suggests that Anglo could be looking to buy out the minorities in Kumba Iron Ore, that would require a cheque of 43 billion Rand or just shy of 4.4 billion Dollars. No doubt there would have to be a premium too and politically, I am sure that there would be push back on that score.

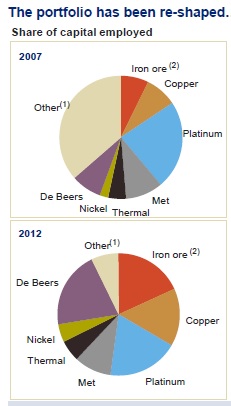

Anglo suggest in another slide that their portfolio is a little more diverse than their peers. Again, are they the right assets? Here is another slide from their presentation, showing how the mix has changed over the last half a decade:

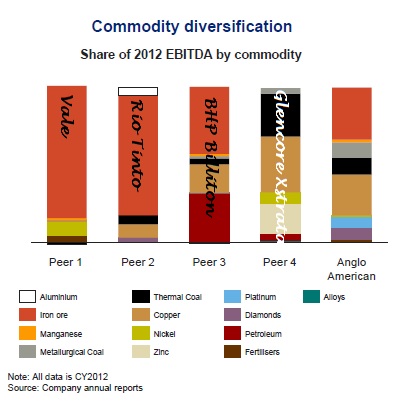

And then lastly, in a world of choices, which one would you be most compelled to buy? We gave you a heads up about the Rio Tinto and BHP Billiton share price performance over the last twelve months, relative to a much worse Vale and Anglo American, the question must be about the earnings make up in the long run. You can see from the charts below, also taken from the same Anglo presentation, that the earnings mix from some diversified miners is not as diversified as one might actually like:

The higher energy mix in BHP Billiton is still more compelling as a longer dated investment, the better geographical mix in more favourable territories and the size and scale issues make it the best choice for us. All very interesting!