Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Tuesday evening we received a sales update from one of our favourite companies which fortunately for us has an ADR listing in New York. Its primary listing is in France and its two biggest shareholders are Nestle (29.3%) and the Bettencourt family (30.7%). Any guesses? I'm talking about L'Oreal.

Sales came in at 11.7bn Euros which was up 5.4% on a like for like basis. Highlights include further market share gains in Europe and North America and strong growth in emerging markets. This however came in below expectations which sent the share down 3% on the open. Then "investors" realised that people around the world do still want to look beautiful and that a little hiccup is not the end of the world. The share closed flat for the day.

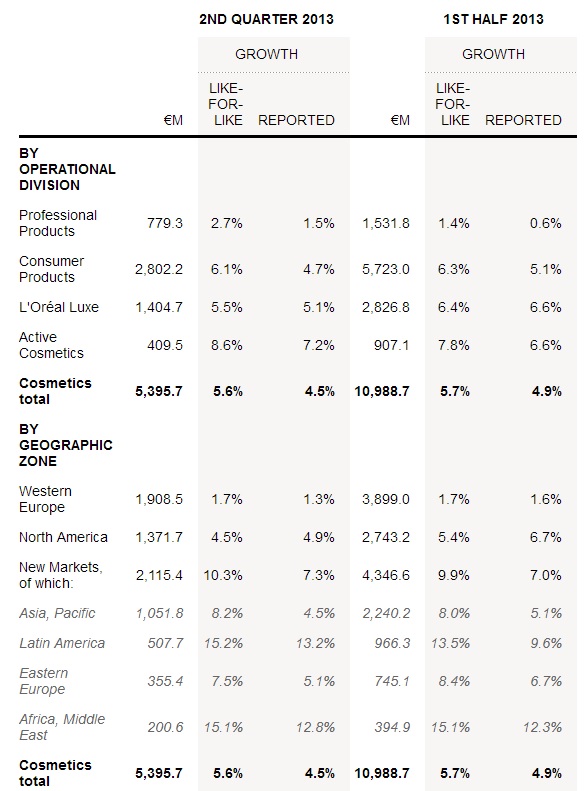

I realise it is a lot to take in but below I hacked a table from the sales announcement which came from the L'Oreal website. It tells you what products they sell, where they are selling it and how fast sales are growing per region and per division. The difference between the 10,988 million Euro you see there and total sales is the individual operations, The Body Shop and Dermatology.

As you can see from the table, New Markets are growing fast. Although it is already 39% of sales you can see that this is going to become more and more significant. Africa and the Middle East only contribute 3.6%. Wow that is nothing. I am told that people in Nigeria love their cosmetics, when they become wealthier and can afford the higher end brands of L'Oreal it will become a huge growth market for the company.

L'Oreal remains one of our core aspirational consumer stocks. We will look closer at valuations and other details when the results come out in August. Another interesting story came to my attention via The WSJ after the release. In an article titled L'Oreal Breaks a Nail in the US the author Renee Schultes make an interesting point. Her words, better than mine.

"Of course, unlike its lipsticks, L'Oréal's shares don't come cheap. After this year's 22% rise, they trade at 23.1 times forecast 2014 earnings for just over 8% earnings growth, according to FactSet. That partly reflects hopes of a change in L'Oréal's shareholder structure, where Nestle holds a 29.3% stake. An agreement that gives the Bettencourt family the first option to buy Nestlé's L'Oréal stake expires in April 2014. If L'Oréal bought and then cancelled Nestlé's stake it would be 17% accretive to 2014 earnings per share, estimates Barclays."

It will be interesting see what happens there. Yes it may be a short term kicker if Nestle is bought out, the company has zero debt so this is certainly a possibility. But we are long term holders of this stock and if it happens then great but if it does not, we will not be too upset.