Byron beats the streets on Tiger Brands today. The company that was founded seemingly in 1896, well according to their website anyhow. Tiger Oats, the company that renamed to Tiger Brands in the year 2000. Fifteen years ago the share price low was 21.13 ZAR. Before you say, well, it is not even 300 now, remember that the company unbundled Astral in April 2001, Spar in August 2004 and Adcock Ingram in late August 2008. If you had continue to hold those, notwithstanding recent underperformance by Astral and Adcock, you would have done fabulously well. For the record, you got 1 Spar and 1 Adcock for every 1 Tiger you held, and 0.25 shares of Astral for every 1 Tiger Brands shares. The collective value of those companies is close to 500 bucks, 495.6 ZAR as of this morning.

And add in the dividend flow over the last 15 years from those four stocks, you get a far bigger number. I did the math. It was not as easy as I thought, but eventually I came out with a number of 118.5125 ZAR for all your collective shares. If you had gone to sleep in 1998 with 4 Tiger shares worth 20 odd Rands apiece, you could have returned today to see your value worth nearly 500 ZAR and be owning 4 Adcock shares, 4 Tiger shares, 4 Spar shares and 1 Astral share, plus nearly 119 Rands worth of dividends. That I guess would have earned some interest. What a great return! And now for the results, thanks Byron!

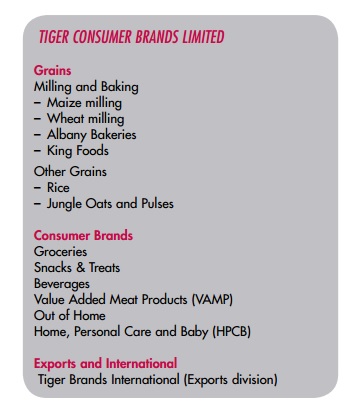

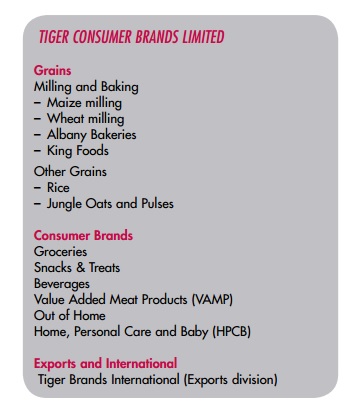

This morning we received results for the 6 months ended 31 March 2013 from Tiger Brands which looked slow as was expected. Before we delve into the numbers lets remind ourselves what these guys do and where they make their money.

As you can see from the image above which I hacked from their latest annual report, the company is split up into three divisions. Amongst the consumer brands includes Purity, Energade, Oros, All Gold, Black Cat, Koo, Crosse & Blackwell, Fatti's & Moni's, Doom, Peaceful Sleep, Kair, Ingram's, Beacon, Jungle and Maynards to name just a few. I am sure you have heard of a few of those.

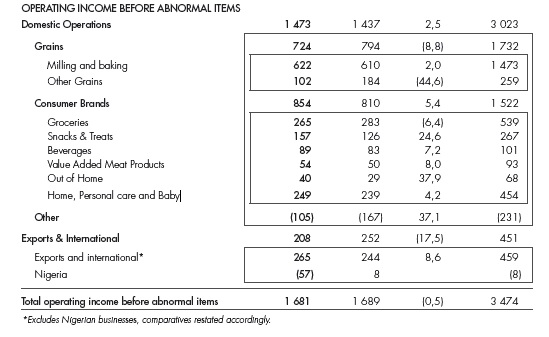

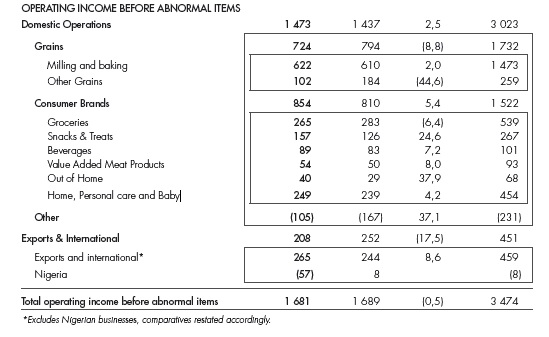

So where do they make the money? Below I cropped the segmental operating income from the latest numbers. As you can see, grains contribute nearly 40% of profits, consumer brands close to half and exports the rest. The exports business is basically their African growth story. Nigeria includes the recent acquisition of the Dangote Flour Mill, we will cover that later.

The Numbers. Headline earnings per share grew 4% to 818c, if you exclude the dilution from the Dangote acquisition earnings were up 14% to 897c. We have to include the dilution in our analysis however because we will happily include the growth in earnings when those start coming through. Group turnover increased 7% if you exclude the Dangote addition. The stock trades at R290 or 15.9 times consensus earnings of 1820c for the full year. I wouldn't be surprised if that comes down due to the dilution.

The grains division grew 6.7% but operating income decreased due to price differentials arising in the rice market. The company has embarked on many capital projects so far this year in order to grow this division.

Consumer brands turnover was flat due to raw material cost pressures which increased prices and decreased volumes. As you know the consumer is under pressure and these price increases are taking its toll. Again a lot of capital projects are being embarked on in this division in order to improve manufacturing efficiencies. The Mrs Balls acquisition was also completed in the period.

Exports grew 13% and operating income grew 9%. This is where the excitement is coming from. The Dangote acquisition in Nigeria is only expected to start contributing after two to three years. There is a lot of work to be done there but you can see why milling and processing grains in a poor country with 162 million people sounds attractive. As long term investors we are more than happy to wait for this to bear fruit.

Yes the numbers are not exciting but the South African economy is slow at the moment. I do not believe this will be forever. On top of that they have strong relations with businesses such as Shoprite and Massmart who are planning on massive expansions into Africa. They will bring Tiger products with them without Tiger having to worry about building shopping centres and other infrastructure. We are very happy to buy into the biggest food producer on this hungry continent of ours.