Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday I went to the Famous Brands results presentation for the full year ending 28 February 2013. It's hard not to be impressed with a business that has managed to grow earnings on an average annual basis of 21% over the last five years. Of course the share price has followed suit, now trading at R94, up 482% from the R16 it was trading at 5 years ago.

Let's see how they went over the last financial year. Revenues grew 17% to R2.5bn which resulted in headline earnings per share growth of 22%. This equated to 339c, of that 250c will be paid out to shareholders as a dividend. As mentioned above, the stock trades at R94 which puts it on a historic PE of 28 and a dividend yield of 2.7%. Now there is no doubt this is a good business, but is it a good investment at these levels? Let's delve deeper.

For the year they opened up 140 new stores and revamped 136. According to CEO Kevin Hedderwick this was slower than normal because of a slowdown from their petrol depot clients. They look to open well north of 200 this year. These stores took the overall network to 2163 restaurants, 1881 in South Africa, 172 in the rest of Africa and 110 in the UK (these are all Wimpy's).

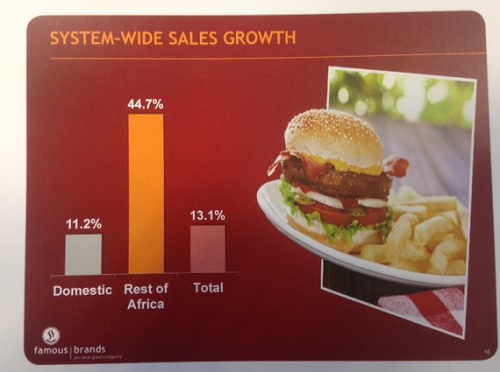

The sales growth is interesting, as you can see from the table below the rest of Africa is flying and now compromises around 7% of overall sales. A lot of this growth is attributable to new stores but even same store sales were up 28.3% in the respective areas. Local same store sales were up 7.7%.

That looks at the front end side of the business but what is so exciting about this model is that these stores are all locked in clients to their logistics and manufacturing business. This business has taken huge advantage of the economies of scope strategy. Basically they are trying to buy or replace any outsourced service which they can do themselves. Why pay an external supplier when you can buy the Coega Dairy factory and supply cheese to all your franchises yourself?

Another good example of a benefit of economies of scope happened within the Steers franchise. People were complaining that the burgers were too expensive. So instead of margin compression for the Steers franchisees, they supplied the meat at a cheaper price which allowed Steers to become more competitive. Yes margins in the meat manufacturing division came down but the growth in sales as a result more than made up for it.

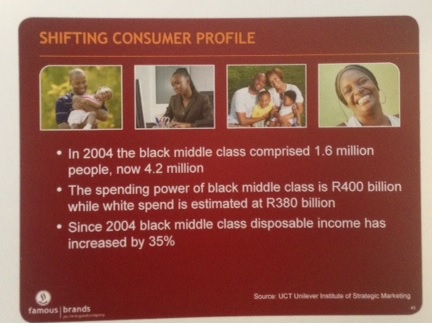

What does the future look like? Here are some interesting stats from the presentation which explains a lot for all retail in South Africa. As you can see from the image below, things have been getting better for a lot of people and I expect this to continue.

That is just locally, the prospects for the rest of Africa are huge. Kevin Hedderwick mentioned that he is in regular contact with Whitey Basson and they plan on following Shoprite into the shopping centres being built in places such as Lagos. The base in these places is so low and the choice of restaurants is extremely limited.

Having been to the presentation and seen what they are up to behind the scenes I think the potential for this company is still in its infancy. It is competitive out there but these guys have the infrastructure and experience to dominate. They have low debt and are extremely cash generative, I am happy to buy at these levels.