Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Decent. That is the very best way that I can describe the full year numbers from Vodacom this morning. No, very decent in fact and very respectable in an environment that is a little meh. Everyone will get excited about the dividend. In a world with low yields everywhere, this is one that you have to get excited about. For the full year the dividend declared was 785 cents. Less the 15 percent withholding tax and you come to 667.25 cents, a very favourable 5.7 percent historical yield on the Friday closing price of 115.82 ZAR per share. Headline earnings for the full year increased 23 percent to 872 cents, giving the company a fairly modest earnings multiple of just shy of 13.3 times. Not expensive, not overly cheap.

Revenue growth was pedestrian, up 4.5 percent to 69.9 billion ZAR for the year, most of the growth coming through the data offering. Data service grew 22.2 percent with active data consumers up 22.5 percent to 18.5 million folks now. Smartphones folks, that is what it is, everyone wants one, everyone wants to be connected to the internet. And of course tablets, people want those too! Data revenue as a whole clocked (in South Africa) 8.882 billion ZAR, which was an increase of 16.3 percent. The last quarter of the financial year showed the fastest growth, a 20 percent increase over the corresponding quarter.

And that is in revenue, in traffic the number grew nearly 40 percent for the full year. Smartphones on the network increased to 6 million, an increase of 1.2 million over the year. But there are 30.3 million active subscribers on the South Africa network, the way I see it, 24.3 million active users on the network DO NOT have smartphones. Less than 20 percent of the local users have "clever" phones, enabling them to get active on social networks, access the internet and email. The group continues to invest heavily in the data network, total capex last year was around 9.5 billion Rands.

Even though this is the case, with smartphone users increasing, the average monthly usage is still only 139 megabytes, but thats including a whopping 43.4 percent increase in data. The average photo taken on my admittedly swanky phone is 2.2 megabytes. So, if I were average, that is only 63 photos downloaded from my favourite social platforms. Of course the photos are compressed, the average Facebook photo is around 60kb. So, you can see a lot more than two photos of your friends a day. An average sized email is 75kb, so, if you were average, you could only download or upload 61 emails a day. That is pretty average, don't you think? I guess what I am try to say is that the base is still exceptionally low. The demand side for smartphones and the adoption rate is huge. It is more than just a phone, it is increasingly a lifestyle. As a friend on Facebook said a few weeks ago, "So, which beautiful place this weekend will you spend with your phone?"

But that aside, this is a business, a public one that has public shareholders and as investors, we must look for the best possible return. If you allocate your capital to this business, what should you expect? Well, for starters the global procurement strength of their major shareholder, Vodafone (65% holder of Vodacom), has saved them some serious money. Group expenses only increased 0.9 percent. As a result margins increased. This is just one of the benefits of having a large external shareholder like Vodafone.

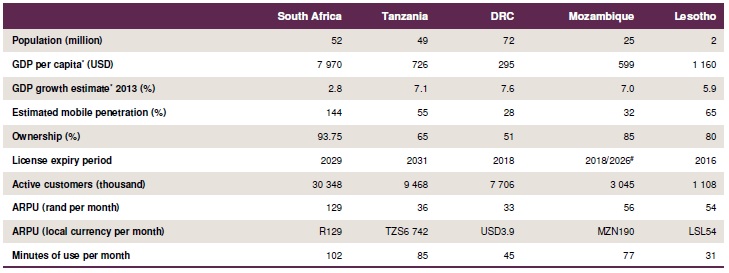

My only concern each and every time that I cover the very good numbers from Vodacom is that they are not really geographically diversified. From a customer point of view, 21.4 million of their 51.7 million customers are from outside of South Africa. But at an operating profit level, only 6.2 percent are "international". International of course means Tanzania, Mozambique and the DRC. Small contributors, BUT total population (as per my interwebs reading) of those three places are 138 million folks. And if you add in the South African population, at 51 million, you get to just less than 200 million folks out of the 1.033 billion population across the continent. North Africa has 196 odd million people, according to Wiki, so in theory, Vodacom have coverage of 23.7 percent of the population of Sub Saharan Africa. Suddenly that sounds like a lot. Ooops, sorry, we forgot Lesotho, with their 2 million population, small, but a contributor.

Here is a wonderful slide from their presentation this morning:

This shows "nicely" what I was going on about, large population, the base is very, very low. The DRC is still a mess, but there is huge potential there. I am sure that many, many people would give a lot for an inch of stability. I guess progress is all relative, and in the case of the DRC I would be true to say that notwithstanding all the shenanigans in Kinshasa, the country is relatively better off than even a decade and a half ago. But, as ever, nobody knows, and nobody would call it with any great certainty.

For reasons of their major shareholder now, the geographical shackles, Vodacom was limited in the territories that they could and could not buy licences. Parent Vodafone wanted the "better" ones across the continent and currently operate in Kenya, through Safaricom and Ghana as Vodafone. And then of course through Vodacom here. I wonder if it makes sense in due course to transfer their holdings in Ghana and Kenya to Vodacom here? I wonder......

So whilst data might be getting cheaper and cheaper, calling is going to get less and less. Someone even suggested to me the other day that Vodacom were preparing for free calls on some networks in the coming years, data users are going to be more and more important. It matters here then what Telkom do. I suspect that luckily for both MTN and Vodacom that Telkom and the government agenda will continue to render the fixed line operator incapable of getting ahead. The stock was initially higher, but has settled lower in a flat market. We continue to recommend the stock as an auxiliary holding to complement high yield seekers other holdings.