Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

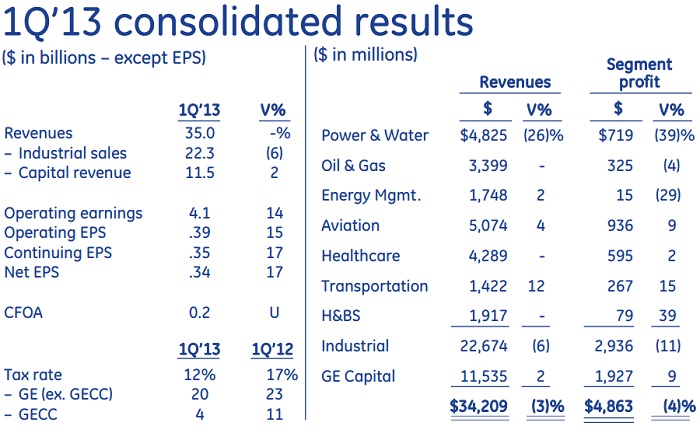

On Friday we saw first quarter results from one of the most fascinating companies around, General Electric. Why are they so fascinating? We will go into the details later but first let us refresh our memories of where this massive conglomerate makes its money. This table below from their presentation shows where earnings came from in the first quarter.

It is an interesting mix. Power and water have taken a large hit because of weakness in the European market. But this number is volatile and has been factored into the price. Analysts look at future orders and in this segment we saw nice growth. But as you can see the rest seems to be doing alright. Oil and Gas, Energy management, aviation, healthcare and Home & Business solutions are all sectors we like and have good growth prospects as global GDP grows. The bank still has a huge influence on earnings but a bit of banking exposure in a growing US economy with a strong housing market is not necessarily a bad thing. The company is working on reducing the overall size of the bank.

Although overall sales were down operating earnings increased 14% compared to the first quarter last year to $0.39. This was thanks to cost cutting and the sale of their NBC stake. The company is expected to make $1.67 this year which trading at $21.59 puts the company on a forward PE of 12.9. I would say that is fairly reasonable, especially for a solid defensive operation. If the company were to sell of its separate divisions there is definitely value to be unlocked.

More importantly the order book grew nicely, this from CEO Jeff Immelt. "Our equipment orders were strong in the quarter, growing 10%, with Oil & Gas orders up 24%, and Aviation up 47%. In growth markets, equipment and service orders grew 17%. We ended the quarter with our biggest backlog in history."

I guess this is a company that really benefits from confidence. If countries and businesses are confident they are going to spend on the industrial equipment that GE sell. And why do I say the company is so fascinating? Take a look at this link, it lists the products that GE sell. It goes on forever. And with a motto of "Imagination at Work" I am told that the kind of innovation at this company is mind blowing. And if you are a Greeny check out the link http://www.ecomagination.com/" target="_blank">Ecomoagination which looks at all the GE initiatives which aim at helping the environment.

We continue to add to this stock, it looks cheap and is well geared to providing the world essential products efficiently and economically. If it were to break up into separate divisions the shareholder will certainly unlock good value, as we have seen on a smaller scale with the NBC sale. A must have in our portfolio.