Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

I saw two pieces of news on Billiton yesterday which I thought were interesting enough to share with you. The first was a statement released by the company themselves regarding copper and how supply may exceed demand this year. As you can imagine the demand for copper over the last ten years has surged like never before. How do miners react? They ramp up production. Last year Chinese demand grew by 11.7%, according to analysts this number will only increase by 5% in 2013.

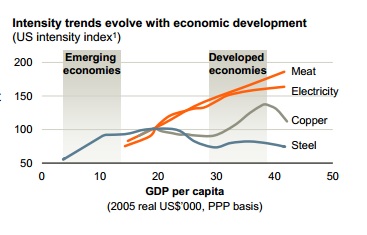

Billiton have been expanding heavily on their copper assets increasing their 57.5% share of Escondida (biggest copper mine by production on the planet) by 32% last year. Is this an issue for the copper price? Probably in the short run but as we always say, we are in this one for the long term and that picture still looks bright. I will never forget that graph Billiton inserted in a presentation called Building momentum in Base Metals which they released in June last year. I will insert it again to remind you

You see that copper demand actually accelerates when an economy becomes developed. China's GDP per capita is just above $6000 so they are still comfortably within the developing market section. That growth in demand is still due a big acceleration.

The other piece I saw also ties in with this graph. You see how electricity growth is almost linear. That makes sense, the richer you are the more energy you consume. The other article that caught my attention was an update on the joint venture between Billiton and Exxon to build the world's biggest floating natural gas processing and export plant North West of Australia. Here is href="http://www.reuters.com/article/2013/04/02/exxon-bhp-lng-idUSL3N0CPQS920130402" target="_blank">the article from Reuters which is certainly an interesting read. The plant will be half a kilometre long and easily the world's largest floating facility.

It is only expected to start producing in 2020 but it reminds me what a big part of our future gas is going to be as an energy source. This project could cost Billiton up to $12bn along with the big bucks they have already spent on ramping up their gas assets. If they are willing to spend this much money on the energy source along with other big companies you know that the ramp up in supply is going to be huge in the future. I am not too worried about demand, we know that the world is increasingly hungry for energy.

I do wish however that these kinds of projects were being planned on the Mozambique border where massive gas reserves can be found. This would benefit us immensely, especially if Eskom started embracing gas as an alternative to coal. A bit late for that now though.