Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

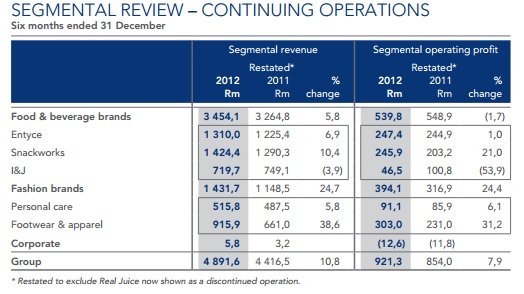

This morning we received 6 month results for the period ending December 2012 form AVI. The table below tells a thousand words, explaining segmental revenue, profits and which businesses are growing and which businesses are slowing.

Within Entyce sits all the beverage brands such as Five Roses, Freshpak, Frisco and Koffiehuis. Snackworks includes the biscuits you dip into these beverages such as Bakers. It also includes Provita, Baumann's and Willards. I&J is a deep sea Hake fishing company which I am sure you have come across before.

Within the Fashion Brands division includes Spitz which is a leading branded footwear retailer. Green Cross which is their most recent acquisition is also a retailer in footwear. And Indigo brands which produces and distributes personal care products such as Yardley and Lentheric. Now that you know the mix let's go back to that table. As you can see the food production is still the biggest revenue driver and growing moderately while the fashion brands have the margins and are still growing fast. That Spitz business contributed around R250 million in profits for the 6 months. They bought this business for R375 million in 2005. You can safely say this was a great acquisition. But I am sure AVI were integral in leveraging off this brand. South African's are obviously very fond of fancy shoes. If it weren't for a weaker rand increasing input costs this part of the business would have done even better.

The table also shows us that the I&J business is struggling and as an effect becoming less significant. Fish are depleting, it is certainly a tough business to be in. I am sure they would sell this if an offer was put on the table. At 5% of profits i wouldn't be too concerned but I'd like to see it out the portfolio if possible.

For the group revenues grew 10.8% thanks to volume growth and higher prices. You see consumers had to absorb a weaker rand. Operating profit increased by 7.9% to R921.3 million which equated to headline earnings per share of 210c. Because of the luxury retail division, the second half of the year is usually well below the first. Earnings expectations for the year are closer to 360c. Trading at R57 we see 16 times forward earnings. I'd say that is pretty fair considering their business mix.

Except for I&J every single brand within the mix has a good future in my opinion. The food manufacture division will benefit from supply agreements with the likes of Shoprite and Massmart who are expanding throughout Africa. You already know my thoughts on coffee, tea has a similar future. The luxury retail segment fits within our aspirational consumer theme and we have already seen how well they are doing. I believe this will continue. On the back of a tough half which included a weak rand and a tough period for I&J the share price has flattened somewhat. I see this as a good opportunity to buy.