Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

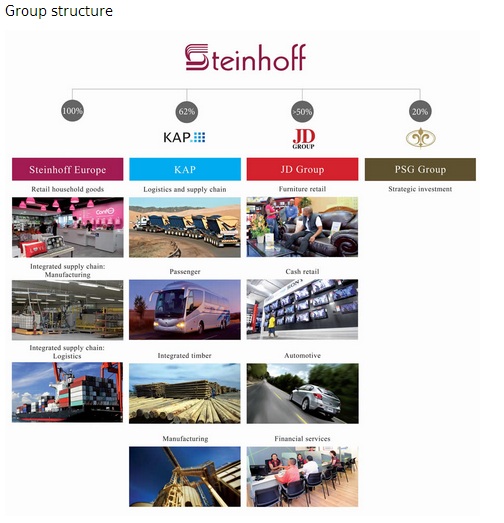

Yesterday we had 6 month results for the period ending December 2012 from Steinhoff International. Wow there are a lot of moving parts here. This picture which I hacked from their website sums up the group much better than I could ever attempt.

Sasha does a great explanation here of how the group came to such a structure so I won't waste my time explaining it again. Steinhoff looking to take control of JD Group.

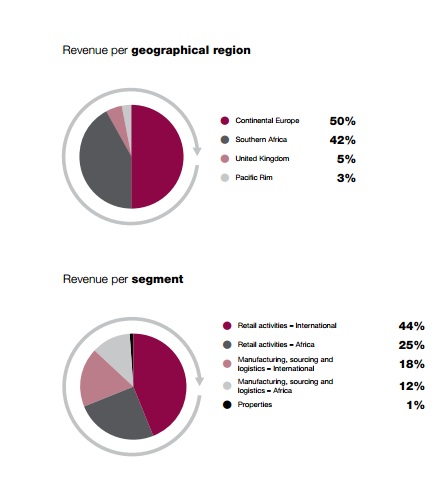

So what do the numbers look like? Paul commented yesterday when we were discussing them that every year the group is different so there actually aren't any comparable numbers. Regardless of that let's see what they say. Revenues increased 52% to R57.3 billion. Operating profits came in at R5bn. After all costs and finance charges this equated to earnings per share of 174c which is up 5%. Earnings for the full year are expected to come in around 340c yet the stock trades at R26.70. That is a forward multiple of 7.8. We will discuss later why this stock is so cheap, first I want to see the significance of each business to the group, these pie graphs should do the trick.

And this is why the stock is so cheap. Retail in Europe sounds like the last place you want to be. They own Conforama which is the second biggest furniture retailer in Europe. The South African retail division is mostly JD Group which trades at an even lower forward multiple of 6.85. All the furniture retailers are cheap plus they have a massive unsecured lending book and we all know how everyone hates that sector at the moment.

You also must not forget that the company has taken up massive debt in order to buy Conforama and the likes. They have long term loans to the value of R38bn and short term facilities worth over R9bn. All this for a company with a market cap of R48bn. The cash flows are positive but again they are pushing their cash into investment activities. They are sitting on around R8.3bn worth of cash and cash equivalents.

So I guess that is exactly why the stock is so cheap. Not only are you playing on a contrarian view of the general market but management is flying full steam ahead on your behalf. It is certainly way too risky for your average retail investor but I still like it if you are willing to take on some extra risk. Marcus Jooste is a wheeler and a dealer and you need to put a lot of trust in his abilities here. Not for the faint hearted. I will leave you with management's outlook.

"The fragmented European household goods retail market continues to present many opportunities to our retail operations focused on the mass-market value-conscious consumer. In many of the markets where the Conforama group operates, our strategy to change our product mix and overhead structure to focus on furniture and home decoration sales (in contrast with electronic goods) should prove decisive in growing margins.

In Africa, the industrial businesses of KAP expect to benefit from infrastructural development both in southern Africa and selected other African countries. JD Group remains confident that its consumer finance division will continue to generate acceptable returns on capital employed. In addition, the previous investments in technology and infrastructure should result in efficiencies to support sustainable margins of the retail business.

The global markets and future consumer spending patterns remain uncertain. However, the group is satisfied that the diversity inherent in its earnings will continue to protect the group against any prolonged downturn in any one market where we operate."