Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday Discovery released interim results for the six months ended 31 December. Usually we do not go to results presentations because they can be a waste of time. The whole presentation will be downloaded on the internet and most of the bigger companies are televised. Just to get a feel for management and give Adrian Gore some of my precious time I decided to go through to the presentation.

Let's look at the numbers first then I'll tell you what I learnt from the presentation.

"The period saw growth in new business annualised premium income up 12% to R5 106 million; normalised profit from operations up 21% to R1 973 million; and normalised headline earnings up 20% to R1 349 million. The period was noteworthy for its greater diversification of new business and earnings, underpinned by the outstanding performance in the UK. The UK businesses contributed R283 million or 14% of the normalised profit from operations, and their strong new business growth contributed to the embedded value growing by 18% to R33.4 billion. The embedded value growth was further driven by the positive experience variances across all the businesses. With Discovery Life cash flow positive, the group was able to achieve this growth with little recourse to capital."

On a per share basis this equated to R2.21. Earnings for the full year are expected to come in at R4.71. Trading at R67.81 after rallying 4% yesterday the share trades on 14 times this year's earnings. Certainly not expensive for a company growing this fast. But insurance companies are valued differently. They look at a metric called embedded value which is similar to NAV but a lot more complicated, determined by Discovery's actuaries. That number came at R59.26 per share. Usually an insurance company trades at a similar number to embedded value but I think because of discoveries exceptional growth prospects we are seeing a premium.

I was very impressed by the presentation. The word innovate was used more than any other and when Adrian Gore demonstrated a few new products there were gasps coming from the crowd. All of these examples were geared towards making the discovery experience easier and better for the client and that is exactly why they will steal market share from their competitors.

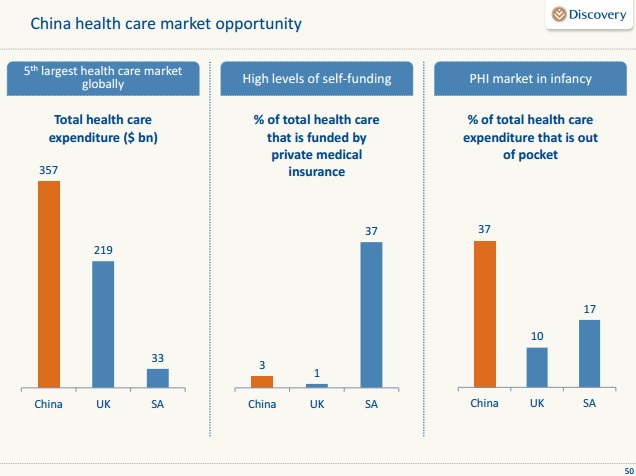

The one slide that stood out the most for me was the one explaining the Chinese market, see below. 37% of health care expenditure comes out of pocket. That is huge potential for growth. Discovery are increasing their stake in Ping An health from 20% to 25% and are very keen to benefit from the potential the Chinese market has to offer.

They are also taking Vitality to the US and have established a partnership with Wal-Mart. Vitality members will get a 5% discount on healthy foods. That theme of a good healthy lifestyle can only grow from here and will never go out of fashion. The UK business has also seen huge growth as the NHI suffers from austerity and private healthcare becomes more prominent.

With very exciting prospects internationally, an amazing innovative and creative model which is stealing market share, an extremely astute management and operating in a sector that has a very bright future we are happy to be adding at these levels.