Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Woolworths released their results for the 26 weeks to end 23 December 2012 this morning. There are a few moving parts in there. But some of the headline numbers look quite strong. And if you take out a few moving parts the numbers themselves look even better: "Adjusting for these items, adjusted EPS and adjusted HEPS were 35.4% and 35.9% higher respectively than the corresponding period."

And what was pleasing to see were the improving margins and cost controls both here and in Australia. OK, here are the quick numbers, comparable store sales increased 9.4 percent, including the new purchase of Witchery sales increased by 18 percent. Profits before tax rose 20.8 percent, I am thinking in this tough environment that must be pretty pleasing. Headline earnings per share increased to 164.2 cents, a 59 cents a share dividend had been declared, an increase of 14.7 percent is comfortably ahead of inflation, perhaps to compensate however for dividends tax. The after dividends tax that translates to 50.15 cents per share.

Operating margins in food were 6.1 percent, in clothing & general merchandise (GM) it was 18.9 percent, both divisions showing solid improvement. The clothing and general merchandise division contributes around two thirds of all Woolworths profits before tax, 66.2 percent to be exact. Of the group profits before tax, the clothing & GM division contributes 52.3 percent. So, it is their most important division, and in third place is their newly acquired plus existing Australian businesses. Food is 26.6 percent of pre tax profits, whilst Country Road is only 16.4 percent. Not insignificant. A weaker Rand of course helped, the Aussie Dollar has been very strong.

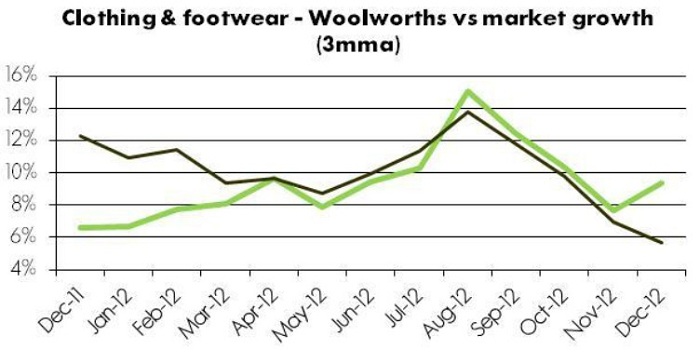

These two graphs are however the ones that stand out, these are from the investor presentation, Interim Results 2013. First, is how Woolies have been able to take market share away from their competitors in their clothing division:

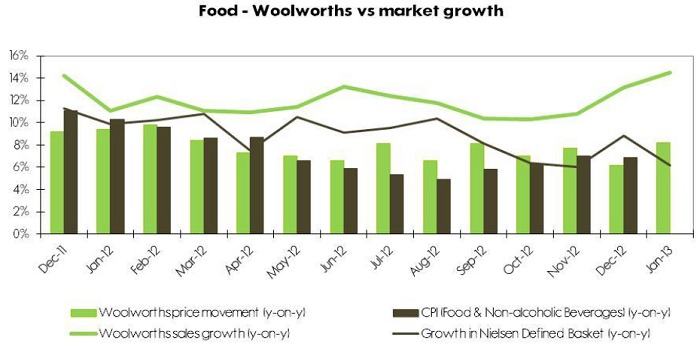

And then in their food division:

You can lie to your customers about a cheap price, or a sale, but you cannot pull the wool over their eyes if you are talking about quality. That is why in these tough times Woolies is growing their market share. That is the one reason. The other and major reason is presented in the outlook section: "We believe that economic conditions in South Africa will remain constrained, especially in the lower and middle income segments of the market where consumer debt levels remain under pressure. However, the upper income segment in which we operate continues to show some resilience. Trading for the first six weeks of the second half of the financial year has been positive, and we expect sales growth to be broadly in line with the first half." The target market of Woolies is OK. In a South African context skills are few and far between, those people with skills are well remunerated. Woolies is an excellence brand, plus they are also very innovative. They have done innovative things like reduce their relative energy bill by 27 percent from the 2004 benchmark. They have also engaged the supply chain and as far as I know are the only organic "farming for the future" chain store.

But, innovation and green technology aside, the stock does not exactly look cheap. However, to many an offshore investor, seeing that Woolies are expending to the rest of the continent, there is a big attraction. With earnings consensus looking at a middle teens growth through the next three years, you have to pay up for quality. The yield is very good, three and a half percent forward at current levels. Of course before tax. But the company has a fairly aggressive dividend policy. We like it a lot and continue to add it.