Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

It was so huge that I couldn't sleep last evening. No, I am kidding, I could. You know the saying, I slept like a baby. I woke up every two to three hours crying for food. Food and hunger, the fact that you can just read this electronically means that you don't share misery of 1 in 7 people on the planet who are hungry daily, that is right 925 million odd people -> 2012 World Hunger and Poverty Facts and Statistics. A company that is committed to producing more fertilizer inputs by building the world's largest potash mine in BHP Billiton, Byron wrote about it last Halloween: Jansen, BHP Billiton's big potash mine is coming.

The company we are talking about of course is BHP Billiton. And just this morning the company released their production report, for the first half of their financial year to end December. To download the .pdf follow the link: BHP BILLITON PRODUCTION REPORT FOR THE HALF YEAR ENDED 31 DECEMBER 2012.

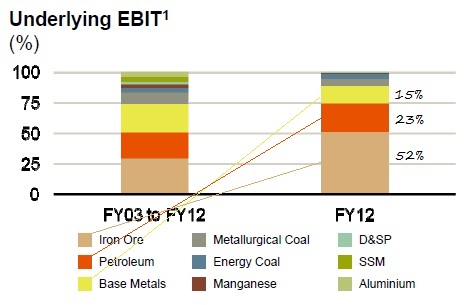

So what are the highlights here? Like I said to one of my favourite journalist friends this morning, ignore most of the smaller divisions. Why? Because of this reason, which we often point out when they have results, this is the graphic to look out for in the presentation that accompanies the results:

So what matters most is that you focus on the three major divisions over the last ten years. Last year there was an extraordinary contribution to profits from the Iron Ore division, which you can see has traditionally contributed around one quarter of profits. The other two major divisions inside of their business are the petroleum divisions and the base metals division. Those three traditionally account for three quarters of profits and in the last full year numbers released accounted for a whopping 90 percent of EBIT. So, like many other "diversified miners" the company only really gets real contributions from some of their core businesses. BUT, the long term EBIT contributions are a little more balanced. And really, at a global level, in our opinion, BHP Billiton is the only truly diversified mining company. From a geographical point of view and from a quality of assets point of view.

Back to the production report quickly here, we will focus on those three divisions. First, the iron ore division: "Western Australia Iron Ore (WAIO) delivered a twelfth consecutive December half year production and sales record as the business continued to benefit from the Company's decade long investment in supply chain capacity." The annual run rate now sits at 188 million tons per annum, although guidance is for 183 million tons for the financial year to end June 2013. The port expansion for their WAIO operations plans to ramp that up to 220 million tons per annum. Still below Rio Tinto and Vale, the two bigger competitors. The half year showed a 2 percent increase on the comparable half, and a 6 percent increase quarter on quarter. Excellent. The two biggest questions to ask are 1) How does Chinese steel demand look in the medium term and 2) with a massive recovery in iron ore prices, what is a normalised price level for the commodity.

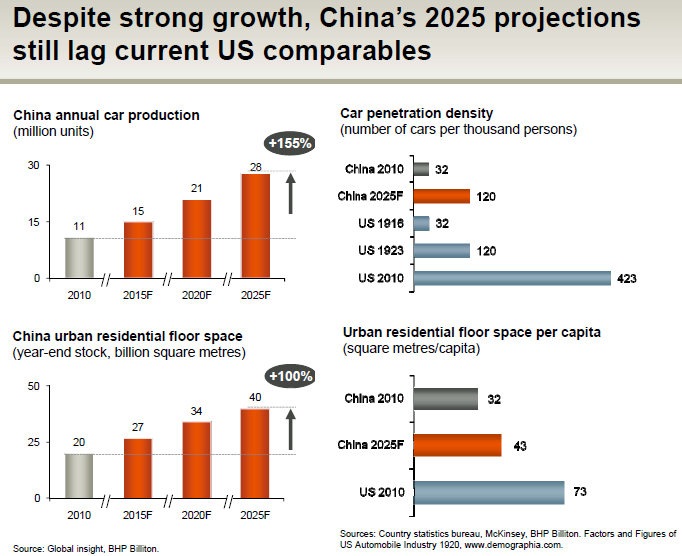

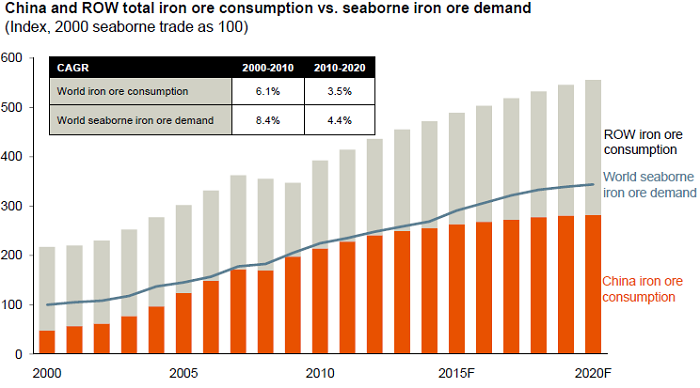

OK, that shows that China's motor vehicle density is the same as it was in the US in 1916. When the Ford Model T was in the middle of their dominance of the motor vehicle market. So, that is where the Chinese are in terms of who owns their own motor vehicle and who does not. And the other point that people miss, most often is that the Chinese might have built a big infrastructure, but it does not exactly stand still. Shanghai is not Pyongyang, things happen, stuff is rebuilt for the needs of their citizens. In other words, should you require a new flat in 20 years time, perhaps the really old ones could be bashed down and new ones built. Just because you build an infrastructure does not mean that you don't build newer buildings, as well as maintain the existing one. Next, another chart from a BHP Billiton presentation that shows that Chinese iron ore demand expectations:

So, by upping their output in the long run, this is to meet increased demand. Next, the petroleum division. Which might actually see some write backs come the next results. I have heard that chatter already. "Petroleum production of 121 million barrels of oil equivalent during the December 2012 half year underpins full year guidance, which remains unchanged at 240 million barrels of oil equivalent." Gas production was lower in the December quarter, for seasonal reasons. But oil production reached a record in the US. Oil is one of my favourite commodities. You cannot re-use any of the refined product. Once used, that's it, no more dinosaurs and plant vegetation decomposing any time soon to give use fossil fuels.

The last important division is the base metals division. Olympic dam continues to struggle, this time as a result of a smelter outage, but full production is expected during the current quarter. But the good news is that at Escondida the "problems" are fewer and total production at the worlds biggest copper mine is expected to increase by 20 percent this year. Overall, copper production (the biggest base metals contributor) increased by 14 percent for the half.

All in all, a well received production report. The only issue, as the WSJ points out, is that there might be as much as a three billion Dollar write down in their aluminium business. The stock is up a percent and a bit, partly due to a weaker local currency. In the short term BTW it seems that the whole idea of selling off assets that were non-core to BHP Billiton in this fine country of ours was the right decision, judging from the current push back to one of their mining peers. And before I explode or implode, better to leave it there.