Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

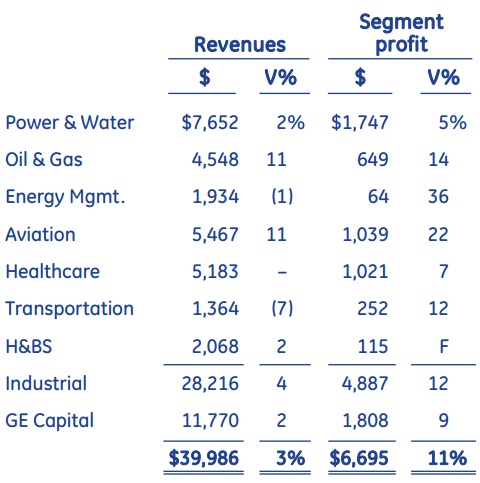

The very first headline I saw which covered GE's 4th quarter results which came out on Friday looked like this from The FT. GE lifted by strong emerging markets growth. I sense a pattern here. To get a better idea of how the big conglomerate is made up in terms of revenue and profit I hacked this table from their 4th quarter presentation.

Every division here is one I would be happy to invest in except maybe GE capital. You know our long term view on big banks. This is a division they are actually trying wither down while there are certainly good synergies between GE capital and the industrial businesses. And if you were not in the know, H&BS stands for Home and Business Solutions.

As far as developing markets are concerned, here is what the CEO Jeff Immelt had to say in the presentation.

"We ended the year with a strong quarter despite the mixed global economic environment. The outlook for developed markets remains uncertain, but we are seeing growth in China and the resource rich countries. With our largest backlog in history and a substantial amount of cash generated by our businesses in the fourth quarter, we have great momentum going into 2013."

And further down the presentation this was said about the developing world.

"Industrial segment growth market revenues were up 9% for the quarter, excluding FX. For the year, Industrial segment growth market revenues increased 11%, driven by double-digit growth in Russia, Australia/New Zealand, Latin America, China, Sub-Saharan Africa and ASEAN."

So what did the numbers look like? For the full year the company made $1.52 per share or $16.1bn which was up 8% from last year. The quarterly number came in at 44 cents which was slightly above the expectations of 43 cents, pushing the share price up 3% on the day. Expectations for 2013 average around $1.68. Trading at $22 the stock trades on 13.1 times this coming years earnings which is neither cheap nor expensive in my opinion.

If the global economy grows, GE will not disappoint. But on top of that they are extremely innovative. If you browse through their website you will immediately pick up on that and it is hard not to be impressed. The world is getting more and more energy hungry, in fact I saw a tweet just yesterday that suggested that there were still 1.6bn people living without electricity. I cannot even imagine life without a smartphone, let alone the basics that electricity provides. The base is still low and as people become wealthier, the demand for GE products will grow. The stock remains a core part of our New York Portfolios. Here is the full report if you would like a further read.