Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The operational review at Amplats happened sooner than most folks expected, later than originally telegraphed. And you can find all of it right here -> Anglo American Platinum takes action to create a sustainable, competitive and profitable platinum business. It is a tough read, because the economic realities are laid out. Four shafts in the Rustenburg region are to be put on care and maintenance, Khuseleka 1 and 2 and Khomanani 1 and 2. Production will therefore be ratcheted back by as much as 400 thousand ounces per annum. The new annual production target is 2.1 to 2.3 million ounces per annum. This is more realistic I suspect and away from the production at all costs.

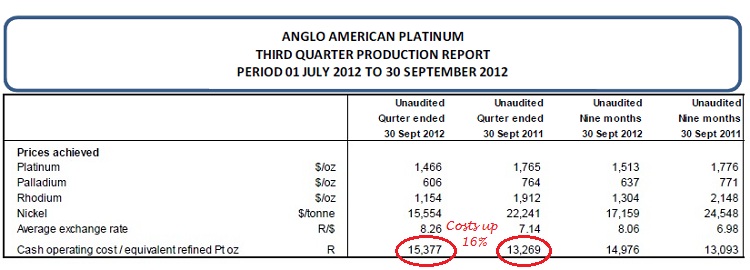

But it is not just those four shafts. "The Rustenburg processing operations will also be reconfigured to align with the revised mining footprint, which may include closing the Waterval UG2 Concentrator and No. 2 Smelting Furnace." And it does not stop there either. Unfortunately the Union mine is up for sale. I say unfortunately, because I suspect that the selling price will not be what shareholders would have probably anticipated. It is by no means a small deal, the THIRD QUARTER PRODUCTION REPORT suggests that the Union Operations had for 9 months produced 174 thousand ounces. So, based on the three quarter year production, the annual run rate was roughly 230 thousand ounces. I hacked that specific production report, I can't believe that they spelt quarter wrong, and that nobody picked that up.

So. Amplats have had to think about the future of the business. And the hard task of being able to create value for their shareholders, after all, shareholders are the people who own the business, and in this case, Anglo American own nearly four fifths of Anglo Platinum, whilst the very distant second biggest shareholder is the GEPF, the Government Employees Pension Fund, with a little over six percent of the business.

There are always losers as businesses seek to optimize their businesses. And in this case it is the jobs of 14 thousand folks, most of them in the Rustenburg area. But all is not lost for these folks, as per the release: "the Company will target the creation of at least 14,000 jobs - an equivalent number of jobs to those that may be affected by the restructuring. The job creation initiatives will focus on housing, infrastructure and small business development in Rustenburg and the labour-sending areas" The sad realities are that there is both lost revenue for South Africa (at current levels I worked out 5.9 billion Rands for 400 thousand ounces), but even worse against the backdrop of unacceptably high unemployment, job losses.

If you add in the Harmony announcement from earlier this month, that amounts to close to 20 thousand jobs "lost" in the mining sector so far this year. And the closure (care and maintenance) of six shafts, two of course from Harmony. I have always maintained that this would be the point where all involved parties would now be forced to sit down and get serious. Because now it impacts everyone. Labour is losing revenue as members will probably be unable to maintain membership, government is losing potential tax revenue, and shareholders have to scale back their expectations for the business in the coming years. Amplats are up nearly a percent, but perhaps more importantly the platinum price is up over two percent. That is just today. And now, for the first time in an absolute age the platinum price has opened some daylight between itself and the gold price. Which is also slightly higher, 1690 Dollars per fine ounce versus 1680 Dollars per fine ounce for the Gold price. I await the responses from government and the unions.