Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Here at Vestact we are forever looking for new opportunities, it's what makes this industry so exciting and by managing money in New York the avenues are endless. Over the last month or so I have been looking at a company which fits a massive growth theme around the world. The company is huge with 20.3billion Euro's in sales last year, this is certainly no secret but I think it is a great addition to our New York portfolios.

L'Oreal has a century of expertise in cosmetics, has 27 global brands in over 130 countries and filed 613 patents in 2011 alone. Brands which you may have heard of include L'Oreal, Garnier, Maybelline, Redken, Matrix and The Body Shop. These range from makeup to shampoos to anti aging creams. I can't say I am the biggest expert on the use of these products but I know that people love them. On top of these brands they also own the cosmetic rights to big global brands such as Giorgio Armani, Yves Saint Laurent, Ralph Lauren and Diesel. You can see how this company fits right in with our aspirational consumerism theme.

Looking at the financials from last year, as you can imagine, the margins in this business are huge. From sales of 20.3bn Euros operating profit of 3.3bn Euros was realised. The share trades at 104 Euro and earnings for this year are expected to come in around 4.88 Euro. A multiple of 21 certainly is not cheap but I never expected it to be. This company is experiencing double digit growth.

What I really like about this company is its growing exposure to the developing world. Last year North America was responsible for 23.3% of sales with 5.5% like for like sales growth. South America, which is a huge cosmetics market, was responsible for 8.9% of sales with 13.2% growth.

Africa and the Middle East saw 10.5% growth and is only responsible for 3.1% of sales, while Eastern Europe which is responsible for 7.1% of sales saw a slight decline of 2.8%. Western Europe is still its main market with 38.4% of sales, as expected sales were slow, only growing 0.6%. But Asia Pacific which is now 19.2% of sales saw massive growth, up 13% and becoming more and more significant.

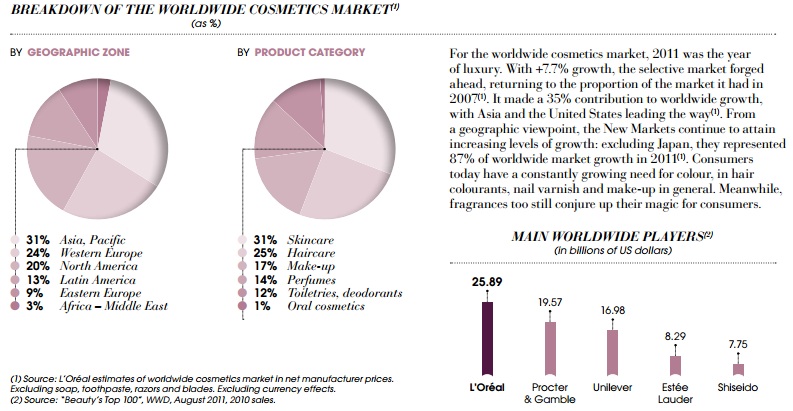

That is L'Oreal's breakdown of sales but the breakdown of global sales for the entire industry is slightly different. I hacked this picture from the

2011 annual report which shows us where they can grow market share, which cosmetics are the biggest sellers and L'Oreal's biggest competitors.

So that was last year's figures, the big question is whether they can maintain this growth? As you can imagine, there is a lot of room for innovation in this industry. The company has 19 research centres, in 5 regions, 16 evaluation centres and 50 scientific and regulatory departments.

Last year they dedicated 721 million Euros to research and development. This gives me no doubt that they will carry on releasing products which they can successfully market to the public at a 65% mark up.

What most excites me though is the macro environment. People love to look good and hate to look bad. Aging is a reality that everyone has to face. As women become more liberalised in developing nations their demand for these products will fly. If your best friend starts attracting all the boys with her new look you are definitely going to follow suit, it is human nature.

Society is becoming more and more vain and from what I hear this materialistic culture in Asia is becoming huge. The industry is growing just as fast for men who have realised that it is not so bad to look after your self thanks to metros like David Beckham and George Clooney making it socially acceptable.

Because of all these factors mentioned above a think this is a great addition to any portfolio. If you have spare cash in your account give us a call and we will get you some. Because You Are Worth It! (sorry I had to throw that in somewhere).