Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Platinum miners lost three quarters of a percent, Anglo American Platinum was offering returning to work once off payments, as well as loyalty payments to those that worked through the wildcat strike and a borrowing facility for those who wanted it, repayable over six months. And still, there is tension in Rustenburg, police are still maintaining their presence there. People try and predict who will be the next in line at Anglo American, Chris Griffiths was one name that I heard, Mick Davis was another. Although the chairman, John Parker, said outright that he is too expensive, and there is no love lost between the two as I understand it. I asked the question, do we need a South African to run what is essentially a non South African business.

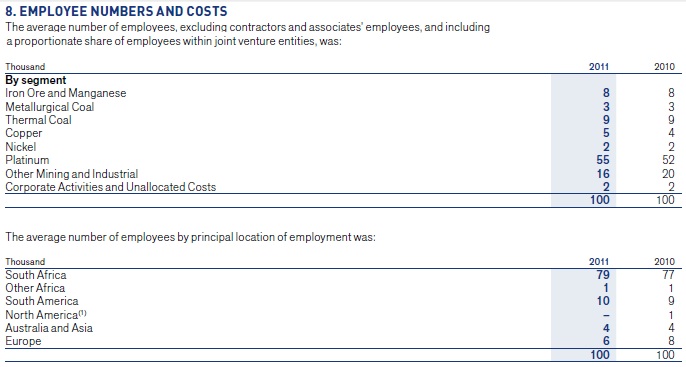

What do I mean by that? A non South African company? Well, I am referring to the part that politicians miss more than anything else, who the owners of the business are. Quite quickly, as per the 2011 Anglo American annual report, the platinum segment (including minorities) is 20 percent of group revenue, but is only 4.5 percent of group EBIDTA. But wait, this is the most important part I think, South Africa represents 44.5 percent of 2011 underlying group earnings. But more importantly, out of roughly every 100 people that Anglo employs, 79 are employed in this country. It is there in the annual report. This is important, I hacked an image to show you, this is taken from page 143.

I guess then it is easy for civil society and the employees to believe that the company is South African. But as you can see, 55 percent of the workforce is within a couple of hours drive from where we sit here. Check out the South Africa - Bushveld Complex map as per the Amplats website. I promise that this piece has a conclusion. When I said non South African business, I meant that the shareholders were not mostly South African.

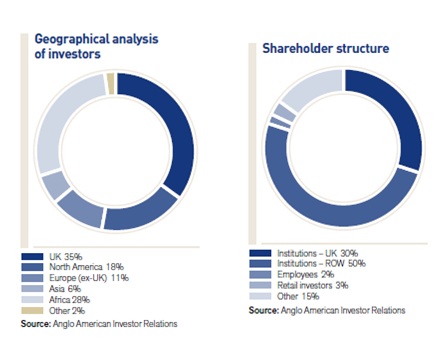

But that part is not as easy to find as I might have thought. On the Anglo American website, they list 5 shareholders as at Feb 2012 who own more than three percent of the company. BlackRock (an American investment company that operates globally) owns 5.97 percent of Anglo American. Black rock, as at 30 September, according to their website manages 3.67 trillion Dollars worth of assets globally. They are bound to own a little of all big companies. Legal and General Group Plc, a group which manages 388 billion Pounds worth of client assets as at 30 June 2012 (from their website) owned 4.03 percent of the company as at the end of Feb this year. Two entities, Tarl Investment holdings and Epoch Two Investment holdings hold 6.75 percent of the stock, but don't vote it. Why? Well, they are the entities that have bought back stock on behalf of the company. I also said, WHAT? The other significant shareholder is the PIC, which owns 5.86 percent. Add these five shareholders up and you get to 22.62 percent. Only one South African shareholder effectively? I finally got my old mate to find it, what a legend, he did. Drumroll:

See that!!! Nearly two thirds of Anglo American shareholders are either from the UK, North America and Europe. Those people actually own the business. As a business owner, you have a right to appoint the best person for the job. And if the best person happens to be South African, to take the business forward, then by all means, choose that person.

So, who should be the new CEO then? The rumour mills are already running at full steam. But as Ron Derby at BusinessDay points out: Platinum is the big problem for Carroll's successor. A note that I read this morning still suggested that the stock was expensive relative to their peers. In fact, the note said that the stock was a sell. These notes are always to be taken with a pinch of salt, but the suggestion is that the unbundling of Amplats is unlikely (too complicated really) and costs at Minas Rio are likely to be short of 7 billion Dollars and first ore shipped over two years behind schedule. As we have said many times, we prefer BHP Billiton.