Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Platinum miners woes I think the stirring of the pot needs to be understood at all levels, I think that the ex president of the youth league (Berets. You wear it like this guy -> President Chavez) has political agendas here. But I also think that the miners concerns are valid. But economically speaking, the mines cannot afford it. The most difficult and bitter pill in all of this to swallow is actually that there is not a shortage of labour, there are many in the labour force who would work for that amount of money in a flash. There are brutal economic realities. Every business and indeed the country itself has limitations. I worked out that over the last four financial years that the big three platinum producers (Amplats, Implats and Lonmin) paid around 21 billion Rands worth of taxes. Lonmin actually contributed only half a billion Rands to the national fiscus. Capex spend by these three, that was trickier, but I found it.

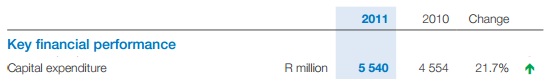

In 2010 and 2011, Impala Platinum, the company, ratified by the board and shareholders shelled out over ten billion Rands in capital expenditure. Check it out, here in their annual report, I have hacked a table too for a visual.

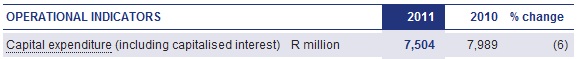

And then Amplats, via their Online annual report, key indicators, the company in those two years invested nearly 15.5 billion Rands in the South African economy by way of Capex. Check it out, hacked from the online report:

And then Lonmin, the sister that doesn't get the dates (sorry), invested 410 million Dollars in 2011 and 268 million Dollars in 2010 in their business. Again, I stress this, the board and the shareholders authorised this capital expenditure that no doubt would have created many jobs. Be they contract jobs, I am not even going to go there, that is a separate argument altogether. That Capex amounts to roughly 5.6 billion Rands when I use the ruling exchange rate. So, the point that I am trying to make is that these three companies invested over thirty billion Rands in their respective 2010 and 2011 financial years.

My point is not so much that the companies have invested vast sums of money in South Africa and that they have paid vast sums of taxes to the government (who arguably have not spent it as well as we would want), but rather that boards made these decisions based on the agreement of shareholders. Money is fickle. Money has choices. And the shareholders are sometimes fund managers making decisions on behalf of their retirees, and pensioners, who are looking for reliable and steady returns. After all, they saved the money and bestowed the responsibility to someone else to give them an acceptable return in their golden years.

That is how it works. If the fund managers decide that they no longer want to be shareholders, they sell. And then the buyer (there is obviously always one for each seller) is making their capital available to fund the business for their growth, you are expecting dividends, and you are expecting the market price to rise to compensate you for the risk taken. No risk willing to be taken, no allocation of new capital. No capital expenditure. No new jobs created. Fewer ounces produced, customers get irritated and look for more ways for substitution. Like this: Honda develops catalyst that reduces use of precious metals by 50%. Like Byron said when I tweeted that link (that was sent to me from our old mate Gareth), this is good for the world, bad for South Africa.