Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

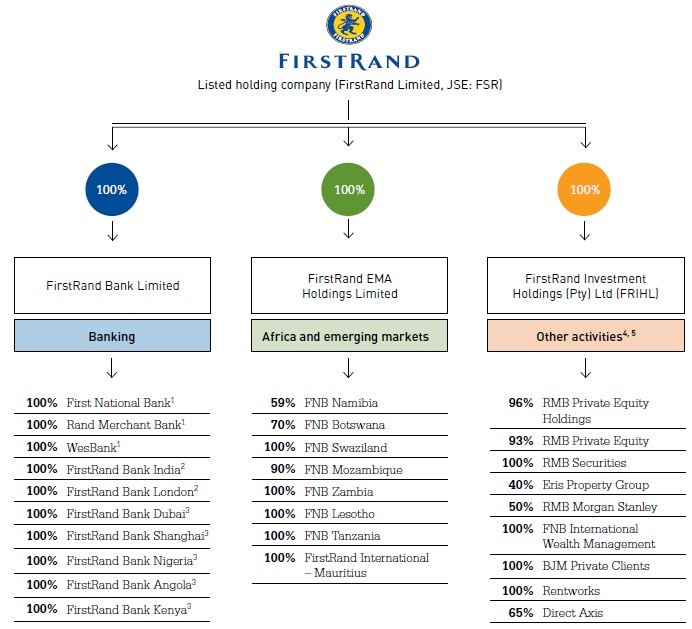

This morning we had full year results from First Rand. There are lots of moving parts here so let's take a look at the structure of the business to get a better understanding. This image hacked from the results presentation pretty much sums it up.

The Numbers. They looked good, Steve has managed to convince many clients to move to FNB backed by what seems to be a better service from my own experience and word of mouth. Diluted normalised earnings grew by 26% to R12.73bn which equated to 225c per share. The dividend also grew by 26% to 102c per share while normalised return on equity grew to 20.7% from 18.7%.

Let's look at the earnings mix. FNB is still the big earnings driver contributing R6.6bn (53%) after growing 25% for the year. RMB and GTS (Global Transactional Services) contributed R3.6bn (29%) after contracting 5% while WesBank contributed R2.6bn (20%) after growing a whopping 40%.

FNB. The bank has been at the forefront of innovation and has really improved its services with the likes of eBucks, fuel rewards, the FNB app and offering iPads and other gadgets through current accounts. This has resulted in 1.3 million new accounts in the year. If FNB was separately listed I would certainly buy the stock for its innovativeness and originality, much like Discovery. ROE grew to 35% whilst margin growth grew thanks to an increase in unsecured lending. That book is now worth R11.4bn, about a fifth of African Bank.

RMB. This is the investment banking division which interestingly announced the termination of outright propriety trading activities due to regulatory changes and the expected macro environment. This is the division we are not the biggest fans of but due to such regulatory constraints it does become less risky. It will however be a lot less profitable than the ''good old days'' before the financial crisis. Earnings depleted from what is described as a high base last year because of muted M&A activity and a tough environment. We still see investment banks as risky remuneration vehicles that benefit employees more than shareholders.

Wesbank. This has grown fantastically and we can see why when we look at vehicle sales figures. Motor finance was up 20% while interestingly unsecured lending played an important role growing 17% to a book now worth R4.3bn. Operating costs were kept down to 3% while corporate new business grew by 15% to R11.8bn.

In the commentary I was interested to see the following statement which I think proves my point that retailers who grow sales north of 15% but say conditions are so horrendous are talking absolute rubbish.

"Consumer demand remained quite resilient throughout the financial year with household spending on durable goods particularly strong. This demand was underpinned by growth in real disposable income and a gradual increase in the uptake of credit by households, particularly unsecured credit. Continued low interest rates provided further support."

I do like the company for its innovation and position to grasp the under banked African consumer. However we prefer African Bank who focus all their activities on unsecured lending, an area where FirstRand are experiencing a big chunk of its growth now and going forward. FirstRand trade on a historic PE of 12.1 compared to African Bank's PE of 10.