Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we got those full year results from Steinhoff which gives us some clarity on the business. Remember we covered the trading update Steinhoff trading update sizzles last week which indicated a 30%-35% increase in EPS and HEPS. The update also explained the makeup of the business with all it's moving parts so if you need a refresher check out the link.

Highlights of the numbers include a 48% increase in operating profits to R8bn, headline earnings per share growth of 32% to 317c and a 23% increase in dividends to 80c. In the financial commentary they state that this headline number was achieved notwithstanding a 17% increase in the weighted average number of shares from the issuances relating to the Conforama acquisition and the groups share swap for its investment in PSG. With that said the stock looks very cheap trading at 2605c. This gives it a historic PE of 8.2 and a dividend yield of 3%.

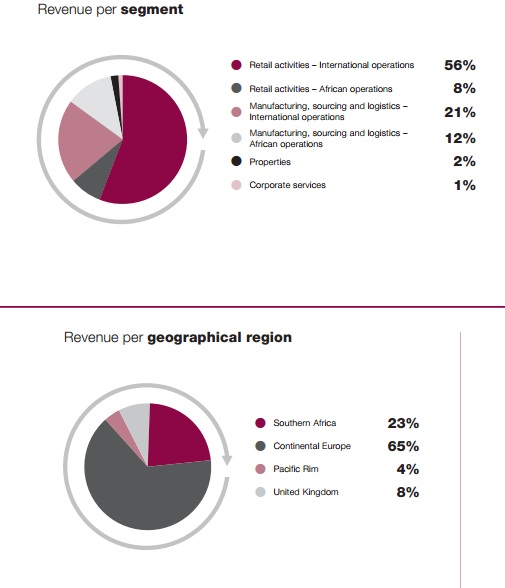

To understand where the sales come from for this company these pie charts say a thousand words.

Here you can see that that its international retail business is the biggest revenue driver. Retail in Africa is small. You can also see that revenue is dominated by continental Europe throughout all its businesses. Southern Africa is only 23% showing us that this is far from a South African company anymore.

Like I said we like the stock on a contrarian basis geared towards less than expected declines in Europe. That Conforama business has in fact showed good growth in this region. "Despite the challenging consumer environment in France and southern Europe, particularly in the electronic product division, Conforama delivered a very solid sales performance driven by the furniture and home decoration product segment. Switzerland and Iberica experienced very strong growth while encouragingly, France gained market share in the important furniture product category. In line with expectations, Italy and Croatia reported a decline in sales. Italy performed in line with market trends while Croatia outperformed the market in furniture and electronic products."

We also believe that most of the negativity is already factored into the share price. Yes we will probably see a decline in sales next year because of the markets they operate in but any unexpected upside will be handsomely rewarded. In fact because they operate at the lower end of the furniture market maybe they'll prove to be quite defensive. We continue to add but not for the faint heated investor. I'll leave you with management's outlook which is positive and informative.

"The global markets and future consumer spending trends remain uncertain. However, the group is confident that the diversity inherent in its earnings will continue to protect the group against any prolonged downturn in any one market where we operate. The fragmented European household goods market and our positioning in the discount sector of the market, provides comfort of the group's ability to compete and grow in the future. The group's strategy remains to invest in strategic brands and real estate assets to expand its retail footprint and securing appropriate sites currently available on attractive terms.

The favourable interest rate environment in Europe is also conducive to property investment opportunities. These investments should secure the longevity of the retail operation concerned, without volatility in profitability that may arise as a result of rental escalations. In addition, the African investment transactions completed during this year will further strengthen and diversify the group. These investments have been consolidated for only three months and will further strengthen the geographical diversity of the group once these businesses have been consolidated for a full year."